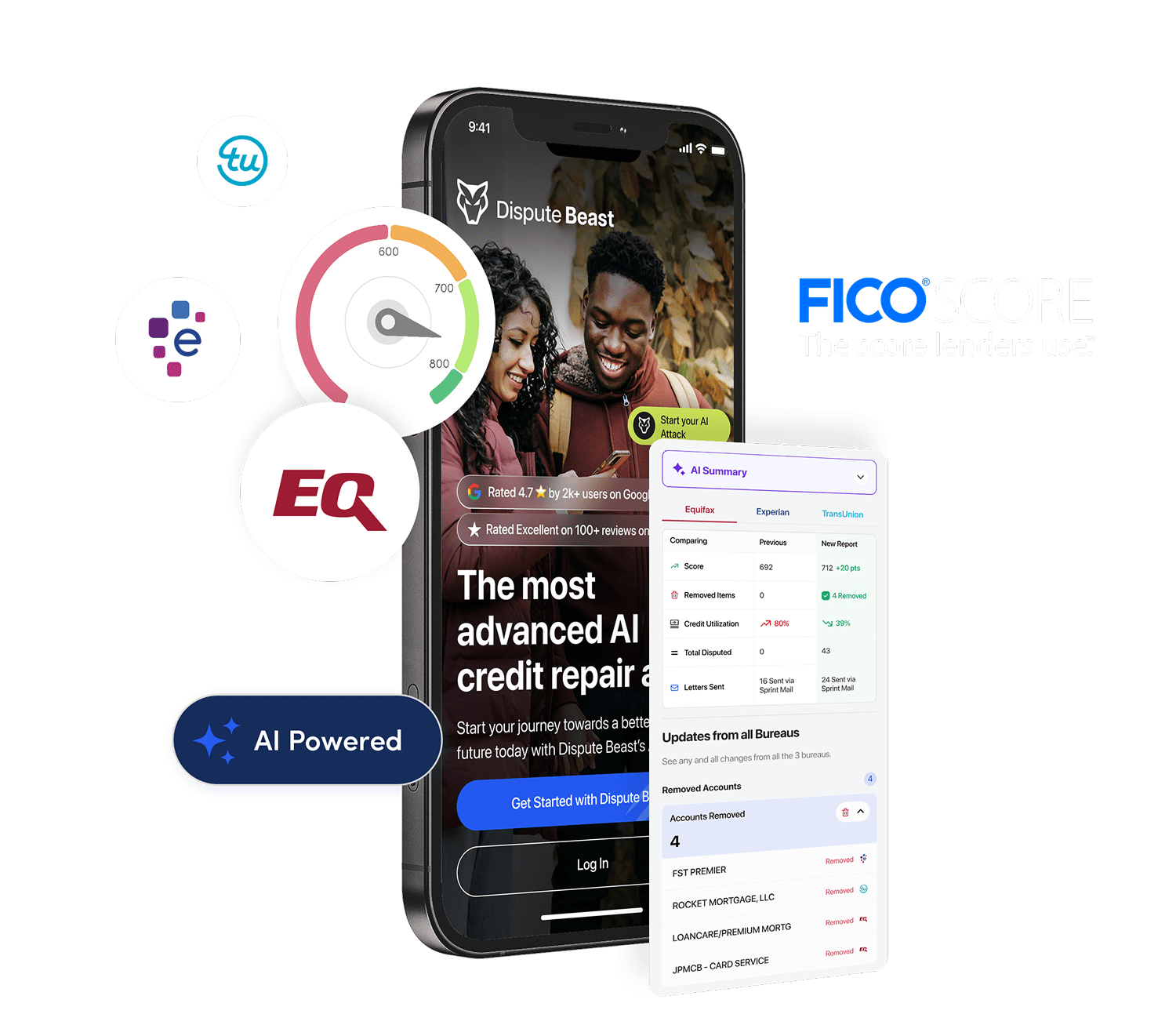

If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Dispute Beast is accessible and easy for users of all backgrounds and budgets, making it a great choice for anyone looking to improve their credit. The platform uses automation and advanced tech to streamline the credit repair process, saving you time and preventing waste compared to traditional methods. Signing up for Dispute Beast is quick, easy, and won’t impact your credit score. Users feel comfortable and confident thanks to its user-friendly design, and you can expect to see results within a month of consistent use. Dispute Beast presents clear credit report findings, making it easy to understand and act on issues.

Are you ready to take control of your credit and improve your financial health? You can effectively enhance your credit profile with Dispute Beast and a little knowledge. Our Ultimate Guide to DIY Credit Repair with Dispute Beast empowers you with a detailed approach on how to fix your credit, featuring Dispute Beast and . Here’s how you can take the reins and steer your credit in the right direction in just 11 steps:

Introduction to Credit Repair

Credit repair is all about taking charge of your financial future by identifying and correcting errors or inaccuracies on your credit report. These errors can hurt your credit score, making it harder to qualify for loans, credit cards, or even rental agreements. Thanks to advances in technology, AI credit repair tools have made it easier than ever to manage and improve your credit scores. AI-powered credit repair services use artificial intelligence to analyze your credit report, quickly identify potential errors, and suggest personalized steps to repair your credit.

By leveraging these AI tools, you can save valuable time and money, while taking proactive steps to improve your credit score. Whether you’re just starting your credit journey or looking to recover from past credit issues, understanding how AI credit repair works is key to building a stronger financial foundation.

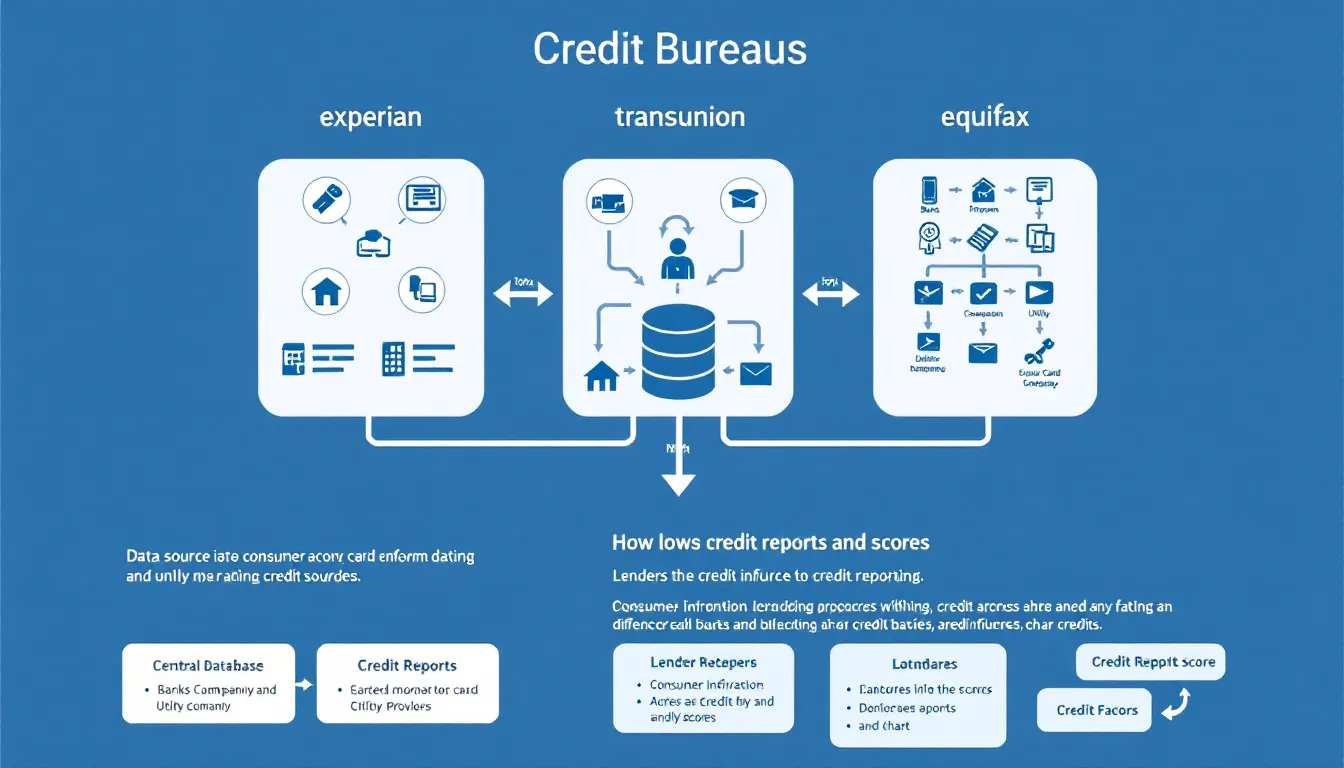

Understanding Credit Bureaus

Credit bureaus play a central role in your credit health. These agencies—Equifax, Experian, and TransUnion—collect and maintain detailed records of your credit history, including your payments, accounts, and credit inquiries. The information they gather is used to calculate your credit scores, which lenders rely on to assess your creditworthiness. Navigating the process of dealing with credit bureaus can be complex, especially when it comes to correcting errors on your credit report. That’s where AI credit repair tools come in. These tools help you manage your credit repair efforts by streamlining communication with credit bureaus, identifying inaccuracies, and guiding you through the dispute process.

Credit repair companies, also offer expert guidance to help you take control of your finances, manage your accounts, and improve your credit scores. By understanding how credit bureaus operate and how AI tools can assist, you’ll be better equipped to protect your credit and make informed financial decisions.

1. Keep Active Credit Monitoring

Regularly monitoring your credit with Beast Credit Monitoring is the first step to fixing your credit. Beast Credit Monitoring provides users with easy, automated alerts and monthly updates on their credit data, making it simple to stay informed and take action. This allows you to track changes and spot inaccuracies early and provides a sense of security, ensuring you’re always in control of your credit status. Don’t let inaccuracies hold you back any longer.

2. Dispute Credit Report Errors with Dispute Beast

Connect your Beast Credit Monitoring account to Dispute Beast to fix errors on your credit report. Dispute Beast allows you to send dispute letters directly to credit bureaus, giving you control over the process. Automation streamlines the dispute process, making it faster and more efficient. The platform presents clear information about which items are being disputed and why, so you can easily understand and track your progress. The AI is trained to analyze your credit data, identifying wrong or inaccurate data entries that could harm your score. By disputing errors promptly, and using AI-generated dispute letters, you are increasing the likelihood of successful outcomes and ensuring your credit report accurately reflects your creditworthiness.

Note:* Make sure you click here to review our blog about a detailed Explanation the Dispute Beast Credit Repair Attack Strategy and Letters* to see why Dispute Beast is the most advanced and most effective credit repair system in the world

3. Improve Payment History – 35% of your credit score (192.50 pts)

Improving your payment history is a significant achievement. This involves ensuring all your bills are paid on time. Users can set up easy, automated payment reminders or autopay to ensure on-time payments each month, making the process straightforward and accessible for everyone. Automation helps streamline your monthly payment schedule, reducing the risk of missed payments. Your payment history accounts for a significant portion of your credit score, so making timely payments is key to improving your creditworthiness.

Note:* Make sure you don’t miss out on our blog post titled “What is Payment History? Here’s What You Need to Know.” Click here to get the full details about how to improve your payment history!*

4. Lower Your Credit Utilization Rate – 30% of your credit score (165 pts)

Maintain a low credit utilization rate — this is the percentage of your available credit you’re using, and it’s best to keep it below 6% if possible. Managing your credit utilization effectively is a significant step in credit repair as it shows lenders your responsible handling of credit. Dispute Beast uses automation to track your credit utilization data and provides easy-to-understand alerts for users, making it easy for anyone to stay on top of their credit usage. By paying down your balances and keeping your credit utilization low, you can positively impact your credit score and demonstrate your ability to manage credit responsibly. Click Here to see the full details on how to master utilization to improve your credit score!

Note:* Don’t miss out on our must-read blog post, “Everything You Need to Know About Credit Utilization to Improve Your Credit Score.” Click here to uncover the secrets to optimizing your credit utilization and boosting your credit score today!*

5. Pay Off High-Interest Debt

Focus on paying off high-interest debts first. This will save you money on interest and improve your credit score—a critical step for anyone looking to fix their credit quickly. Prioritize paying off credit cards with high interest rates or large balances to reduce your overall debt load and improve your credit utilization ratio.

Users can also use other complementary tools alongside Dispute Beast to track their spend and manage their budget more effectively. While Dispute Beast focuses primarily on automating dispute processes and credit repair, combining it with budgeting apps and financial tracking tools can provide a more comprehensive approach to monitoring financial habits and prioritizing debt repayment. AI-enabled budgeting tools help track spending and set up automated payment reminders, which is key for building a positive payment history. This combination helps users stay on top of payments and improve credit health.

6. Keep Old Accounts Open 15% of your credit score ( 82.50 pts)

The length of your credit history impacts your score, so keep older credit accounts open. This practice helps users build a strong credit history by showing a longer track record. Dispute Beast uses data to track the age of your accounts, ensuring you make informed decisions about which accounts to keep open. Closing old accounts can shorten your average account age, which may negatively impact your credit score. By keeping old accounts open and active, users can maintain a positive credit history and improve their creditworthiness over time.

7. Limit Hard Inquiries – 10% of your credit score (55 pts)

Each new credit application can cause a slight dip in your credit score due to hard inquiries. Limiting these inquiries is crucial when trying to repair your credit. Dispute Beast provides users with automated alerts and data tracking to help monitor and limit hard inquiries, making it easier to manage your credit profile efficiently. Avoid applying for multiple new credit accounts within a short period, as this can signal to lenders that you’re in financial distress or maybe a higher credit risk. Instead, focus on managing your existing credit accounts and only apply for new credit when necessary.

8. Add Positive Credit Accounts – 10% of your credit score (55 points)

Consider adding 3-5 new revolving credit accounts. This can include secured credit cards or credit-builder loans, which can help users build their credit profile faster by showing responsible credit management. Use this link for the Dispute Beast recommended accounts. Adding positive credit accounts diversifies your credit profile and demonstrates to lenders that you can responsibly manage different types of credit. Dispute Beast uses data to track the impact of these new accounts, helping users monitor their progress as they build credit. Make timely payments on these new accounts to maximize their positive impact on your credit score.

9. Become an Authorized User

Becoming an authorized user on another person’s account can improve your credit score as long as the primary user has a good payment history. This is a useful tactic for users looking to build or repair their credit. By piggybacking off someone else’s positive credit history, users can benefit from their responsible credit management and build a stronger credit profile. Dispute Beast uses data to track the positive effects on your credit score, helping you monitor your progress. Be sure to choose an account with a long history of on-time payments and low balances for the best results.

Heavy Lifting in Credit Repair

The most challenging part of credit repair is often the heavy lifting—finding and disputing errors on your credit report. This process can be tedious and time-consuming, but it’s essential for improving your credit scores. AI credit repair tools are designed to take the stress out of this process by automating the identification of inaccurate information and helping you create effective dispute letters. With AI-powered solutions you can track your progress, manage disputes, and receive personalized recommendations to improve your credit utilization and payment history. These tools not only save you time but also give you greater control over your credit repair journey. By letting AI handle the heavy lifting, you can focus on building a stronger credit profile and achieving better results, all while reducing the stress that often comes with fixing credit issues.

10. Join the Dispute Beast Community

For ongoing support and advice, join the Dispute Beast Facebook group (join here). Engaging with a community of like-minded users can provide motivation and insider tips on fixing your credit. Surrounding yourself with others who are on a similar credit repair journey can offer encouragement and accountability as you work towards improving your financial health. The Dispute Beast community helps users feel comfortable and supported every step of the way, making it a valuable resource for sharing experiences, asking questions, and gaining insights into effective credit repair strategies.

Avoiding Credit Repair Scams

When it comes to credit repair, protecting yourself from scams is just as important as fixing your credit report. Unfortunately, some companies make unrealistic promises, charge hidden fees, or use high-pressure tactics that put your finances at risk. AI credit repair tools offer a safer, more transparent way to manage your credit repair without falling victim to scams. Look for tools that are upfront about their services, don’t guarantee specific results, and never ask for payment before delivering results. Watch out for red flags like guaranteed credit score increases, requests for upfront fees, or pressure to sign up quickly. By choosing reputable AI credit repair tools, you can confidently manage your credit, protect your finances, and work toward better credit scores without unnecessary risk.

11. Maintain and Adapt Your Credit Strategy with Consistent Actions

Continuously evaluate and adapt your credit repair strategies based on your progress. Each month, users should review their progress using Dispute Beast’s automated data tracking tools, which provide automated reminders and help keep your mind focused on your credit goals. Regular updates are essential to stay on top of your financial health. As you implement these steps and monitor your credit score, be proactive about making changes to your credit strategy as needed. To ensure the effectiveness of your efforts, maintain a consistent approach by attacking negative items on your credit report with Dispute Beast every 40 days for a minimum of six attacks. This persistent and disciplined approach is crucial for successfully improving your credit score.

By staying informed, proactive, and consistent and utilizing tools like Dispute Beast and Beast Credit Monitoring, you’re well-equipped to take charge of your DIY credit repair journey. Staying committed to this process will help you effectively manage your credit repair efforts and achieve your financial goals. Several users described their credit repair experience with AI as life-changing, helping them get closer to significant financial goals like home ownership. By following this guide and maintaining a disciplined approach, you’re setting yourself up for success in managing your credit and enhancing your financial health.

Note:* Make sure you read this blog –* I received results in the mail after my Dispute Beast attack. What do I do next?

Disciplined approach, you’re setting yourself up for success in managing your credit and enhancing your financial health.

Note: Make sure you read this blog – I received results in the mail after my Dispute Beast attack. What do I do next?

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!