If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

When it comes to your credit score, payment history is the heavyweight champion. But what exactly is payment history, and why is it so crucial? Let’s break it down. Your payment history not only impacts your ability to get loans but also affects everyday financial decisions, like renting an apartment or even getting a job.

Understanding Payment History

Payment history is a record of how you’ve paid your bills over time. It shows whether you’ve met your payment obligations on time or missed them. This record is the single most significant factor in determining your credit score, making up 35% of the calculation. Why? Because your history of repayment is a strong indicator of whether you’ll pay future debts on time. Lenders are primarily concerned with your track record of paying back loans.

How is this history collected? Creditors report your payment activity to the three major credit bureaus: Equifax, Experian, and TransUnion. These bureaus compile your data into a credit report, which is then used to calculate your credit score.

Why a Few Late Payments Aren’t the End of the World

A couple of late payments might not wreck your score completely. A solid credit history can buffer the impact of one or two late payments. For example, a late payment on a credit card might hurt your score less than a late mortgage payment. However, keep in mind that no late payments don’t automatically translate into a perfect score. Your payment history is just one piece of the credit score puzzle.

Types of Accounts That Affect Your Payment History

Your payment history encompasses a variety of account types, including:

- Credit cards: Visa, MasterCard, American Express, Discover, etc. – These are revolving credit accounts.

- Retail accounts: Store credit cards from places you shop, like department stores – Also revolving credit.

- Installment loans: Loans with regular payments, such as car loans – Fixed payment loans over a specified period.

- Finance company accounts: Loans from finance companies – Often used for personal loans.

- Mortgage loans: Home loans – Long-term loans with fixed or adjustable rates.

READ ME NEXT: Take charge of your credit with our easy 11-step guide! Learn how to fix your credit yourself, save money, and avoid costly services. Ready to start? Click here to read the guide for free!

Negative Factors Impacting Your Payment History

Certain negative items can significantly affect your payment history, including:

- Bankruptcies: These can linger on your credit report for 7-10 years, depending on the type, severely impacting your score.

- Lawsuits and wage attachments: Legal actions taken against you can also show up in your payment history, indicating financial distress.

Components of Your Payment History

Several elements make up your payment history, such as:

- Payment information on various types of accounts: Reflects if payments were made on time or late.

- The current status of any delinquent payments: Shows how overdue delinquent payments are.

- The amount owed on delinquent accounts or collection items: Higher amounts can negatively impact your score more.

- The number of past due items on your credit report: Multiple past due items can significantly lower your score.

- Adverse public records like bankruptcies: These remain on your report for several years and have a major impact.

- The time elapsed since delinquencies, public records, or collection items appeared: Older items impact your score less over time.

- The number of accounts currently being paid as agreed: More accounts in good standing can improve your score.

Tips to Improve Your Payment History

Improving your payment history might seem daunting, but it’s entirely possible. Here are some actionable tips:

- Pay bills on time: It sounds simple, but it’s the most effective way to boost your payment history. Set up automatic payments or reminders to avoid missing due dates. Creating a budget can help ensure you have enough funds to meet your obligations.

- Get current on missed payments: The older a missed payment, the less it impacts your score. Paying your bills on time consistently, even after past mistakes, can help your score recover. Make a plan to catch up on missed payments and stick to it.

- Contact creditors: If you’re struggling, reach out to your creditors. They might offer assistance like lowering your interest rate.

How Dispute Beast Can Help Improve Your Payment History

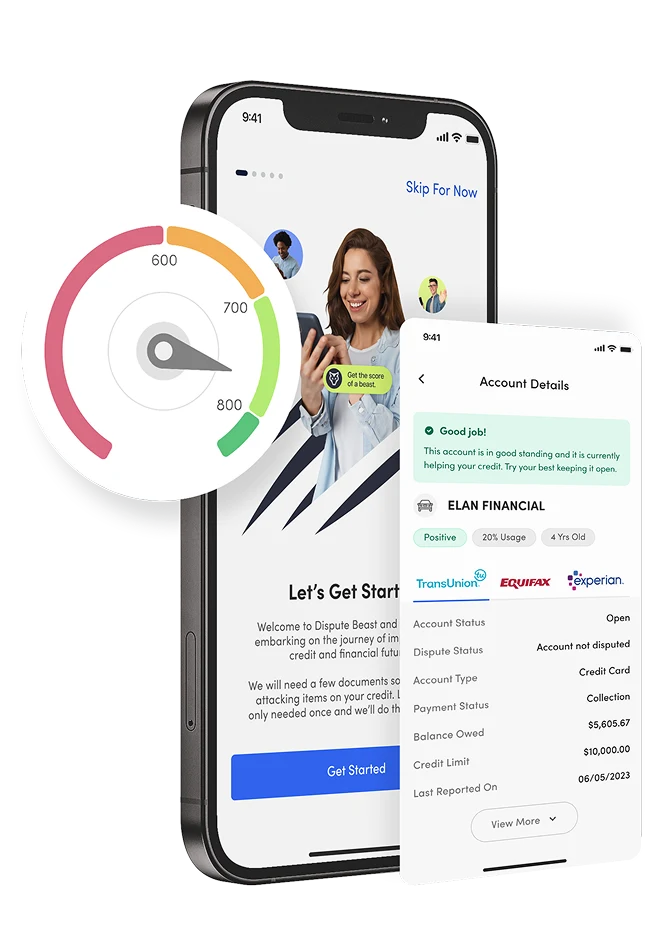

Boosting your payment history isn’t just about paying your bills on time—it’s also about addressing and removing negative items from your credit report. This is where Dispute Beast comes into play. Dispute Beast specializes in identifying and challenging negative items that drag down your credit score.

Attack Negative Payment History with Dispute Beast

Dispute Beast works by disputing negative payment history with the three major credit bureaus—Equifax, Experian, and TransUnion—as well as directly with creditors and data furnishers. Here’s how Dispute Beast can help you:

- Identify Negative Items: Dispute Beast combs through your credit report to pinpoint items that negatively impact your payment history.

- Challenge Inaccuracies: The team at Dispute Beast disputes inaccurate or unverifiable negative items with the credit bureaus and creditors.

- Persistent Follow-Up: Dispute Beast ensures that every disputed item is followed up on, increasing the chances of removal or correction.

Why Payment History Matters

Remember, payment history accounts for 35% of your credit score. Therefore, it’s crucial to start using credit responsibly by paying your bills on time and actively addressing and removing negative items from your credit report. This dual approach can significantly speed up the process of improving your credit score, and Dispute Beast is the perfect tool to help you achieve this.

A strong payment history can open doors to better loan terms, lower interest rates, and more financial opportunities. It’s not just about improving your score but also about gaining financial freedom and security.

Final Thoughts

Your payment history plays a pivotal role in your credit score. Paying attention to it and ensuring your bills are paid on time can make a significant difference. Ready to take control of your credit? Start improving your payment history today with Dispute Beast by your side!

Understanding how credit utilization impacts your credit score is crucial when it comes to managing your credit card usage. At Dispute Beast, we often encounter questions about the best practices for credit card spending and payment. Let’s dive into these aspects in detail, ensuring you have a clear strategy for using your revolving credit effectively.

FREE RESOURCE: Boost your credit score with our Ultimate Guide to DIY Credit Repair! Discover 11 simple steps and how Dispute Beast can empower you to take control of your credit. Ready to improve your financial health? Click here to learn more!

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!