Wondering when your credit score will update? Credit scores usually update monthly, but the exact timing of when will credit score update depends on when your creditors report changes.

Key Takeaways

Credit scores typically update monthly based on creditor reporting schedules and changes in credit activity.

Payment history and credit utilization are the two most significant factors affecting credit scores, accounting for 35% and 30% respectively.

Utilizing tools like rapid rescore can expedite credit report updates, potentially improving scores for urgent loan applications.

How Often Do Credit Scores Update?

Credit scores updated based on data from your credit reports, usually at least once a month. The frequency can vary depending on the reporting schedules of your creditors. To update your credit, a credit score update reflects these changes.

Credit reports typically update monthly, directly affecting your credit score and credit reporting. The frequency can vary due to different creditors reporting on different days.

Timely bill payments and changes in credit card balances can also impact how often your credit score updates.

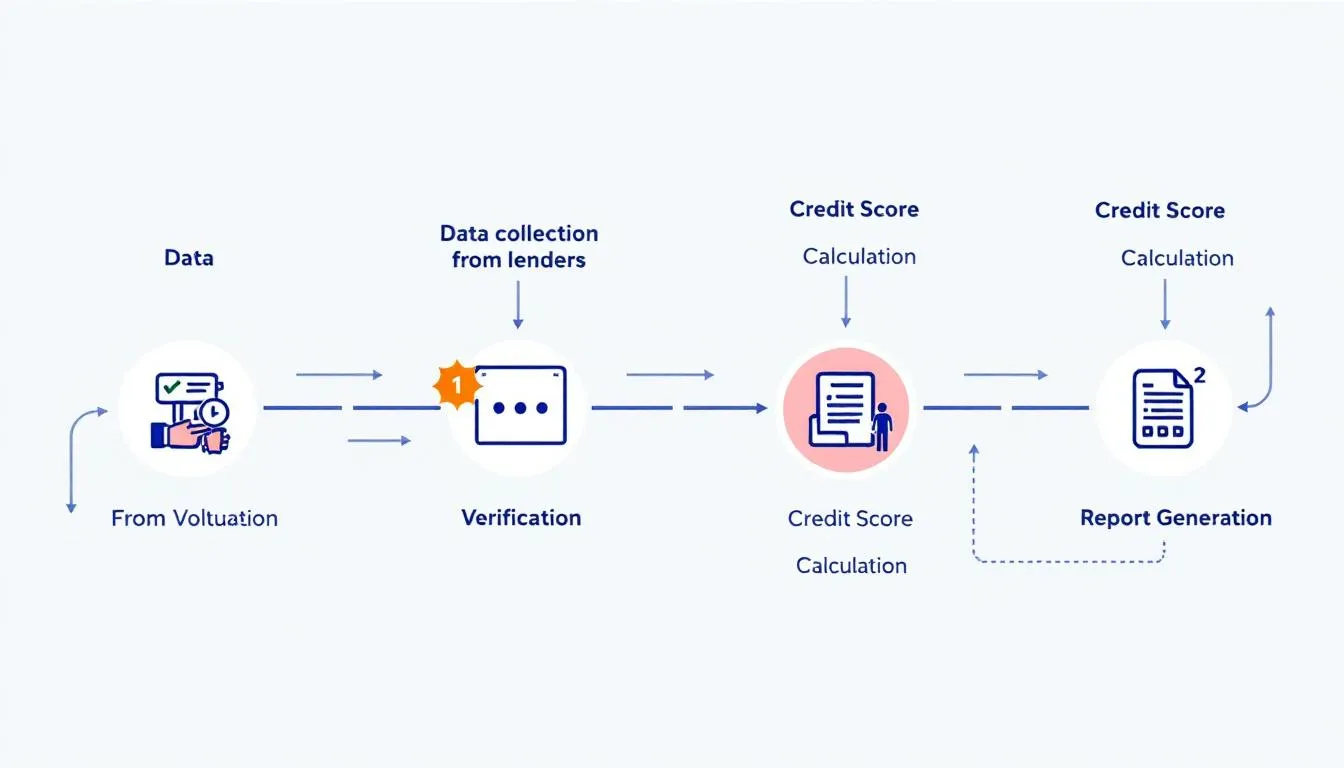

When Do Credit Bureaus Update Reports?

Credit reports refresh monthly, with major bureaus updating every 30 to 45 days. Changes like payments or new credit applications will be reflected within this period.

Creditors typically report balances at the end of each billing cycle, which can take 30 to 45 days. Variations in reporting times can lead to differences in the information displayed across different bureaus.

How Often Do Creditors Report to Bureaus?

Each creditor reports to the different credit bureaus on their own schedule, usually once a month. This can result in your credit report changing multiple creditors times within a month, as reported by the three major credit bureaus.

Variations in reporting times and the fact that not all creditors report to all three bureaus can lead to discrepancies in your lenders report credit report from credit reporting agencies.

Why Your Credit Score May Fluctuate

New loans, changes in credit card balances, and an increase in your credit utilization rate can cause your credit score to fluctuate.

Frequent hard inquiries from multiple credit applications can signal financial distress to lenders and negatively affect your score. New information like a late payment can also cause fluctuations. Even after paying off a loan, improvements may take some time to reflect in your credit score.

Factors That Influence Credit Score Updates

Credit scores are influenced by factors such as:

Payment history

Amounts owed

Length of credit history

Credit mix

New credit

Different scoring models may weigh these factors differently, but consistent financial habits are crucial for a solid credit score and effective credit scoring models.

Understanding these factors helps anticipate the impact of your financial actions on your credit score. The following subsections break down each component to clarify their contributions to credit score updates.

Payment History: 35%

Accounting for 35% of your FICO® Score, payment history is the most significant factor. Late payments can drastically decrease your overall creditworthiness and need to be overdue by at least 30 days before being reported to credit bureaus.

A 30-day late payment can harm your credit score and stay on your report for up to seven years. Automatic payments or reminders can help ensure timely bill payments.

Amounts Owed: 30%

The credit utilization ratio impacts 30% of your FICO® Score. Experts recommend keeping it under 30% of your total credit limit, as large balances can harm your credit score.

Regularly reviewing and adjusting your spending to stay below credit limits can improve your score. Early credit card payments also help lower your utilization rate.

Length of Credit History: 15%

Contributing 15% to your credit score, the length of your credit history highlights the importance of maintaining a good history over time. The FICO® Score looks at the age of your oldest and newest accounts, and the average age of all your accounts.

Keeping older accounts open helps improve the average age of your credit accounts and has a positive impact on your credit score.

Credit Mix: 10%

Making up 10% of your FICO® Score, credit mix contributes to your credit profile. A variety of credit types, such as installment loans and revolving accounts, positively influences your score by demonstrating responsible credit management.

A well-balanced major credit mix shows lenders you can handle various credit obligations effectively, significantly impacting your credit score.

New Credit: 10%

New credit inquiries make up 10% of your credit score. Hard inquiries have a short-term negative impact, and opening multiple accounts quickly is seen as risky, potentially lowering your score.

Spacing out credit applications can minimize the impact, with scores typically rebounding from hard inquiries within a short period.

How Long Does It Take for a Credit Score to Update After Paying Off Debt?

After paying off a debt, the new zero balance will reflect in your scores once reported to the credit bureaus. Improvements can usually be noticed within one to two months.

Zeroing out an installment loan may temporarily drop your scores if it was your only installment account. This is normal, and your score should improve as your credit utilization ratio decreases.

Rapid Rescore: A Quick Solution

Rapid rescore speeds up updating credit reports, reflecting recent changes quickly—useful for urgent loan applications. It requires collaboration with a lender or mortgage broker, as individuals cannot initiate it independently. This new report can significantly impact the approval process.

The rapid rescore process usually completes within three to five business days, depending on circumstances. While it can potentially boost scores quickly, there’s no guarantee, and it may not fix issues like a history of late payments.

Tips to Maintain and Improve Your Credit Score

Consistent financial habits are key to maintaining and improving your good credit score. Keeping your credit utilization ratio below 30% and regularly reviewing your credit report can help identify areas for improvement. Additionally, it’s important to check your credit score.

Establishing a budget and tracking spending enhances your financial health and credit management, as well as your financial behavior. Lenders may provide credit reports suggesting actions for improvement, but these are estimates due to varying scoring models.

Pay Bills on Time

Timely payments are essential for a positive credit score, with payment history accounting for 35% of your score. Regular on-time bill payments ensure a good credit rating.

Automatic payments or reminders can help ensure timely bill payments and reduce the risk of late payments, missed payments, and paid payments.

Keep Credit Card Balances Low

Keeping credit card balances low is crucial for a healthy credit score. Experts recommend:

Keeping credit utilization below 30% of your limit.

Regularly adjusting your spending.

Making early payments. These actions can positively impact your credit cards score.

Limit Hard Inquiries

Applying for credit results in hard inquiries, causing a slight decrease in your scores. Spacing out applications can prevent multiple hard inquiries from negatively impacting your score.

Multiple hard inquiries for the same day type of loan within 14 days are counted as one hard inquiry.

How Dispute Beast Can Help You Manage Credit Score Updates

Dispute Beast provides a DIY credit repair tool that automates dispute letter creation to challenge inaccuracies on credit reports. For example, users can send letters via Sprint Mail or mail them directly, offering flexibility.

The service offers a money-back guarantee if users don’t see an improvement in their scores after a year. Sign up for a free credit report and take control of your financial future with Dispute Beast.

Summary

In summary, understanding when and how your credit score updates can empower you to maintain and improve your financial health. Factors such as payment history, credit utilization, and the length of your credit history play significant roles in determining your credit score. Consistent financial habits, such as paying bills on time and keeping credit card balances low, are crucial for maintaining a good credit score.

Take control of your financial future with tools like Dispute Beast, which can help you manage credit score updates effectively. Remember, your credit score is a reflection of your financial behavior, and with the right strategies, you can achieve a good credit score.

Frequently Asked Questions

How often do credit scores update?

Credit scores generally update at least once a month, though they may be updated more frequently based on your creditors’ reporting schedules. Staying aware of these updates can help you better manage your credit.

When do credit bureaus update reports?

Credit bureaus typically update reports every 30 to 45 days based on the information provided by creditors. It’s essential to stay informed of these updates to maintain an accurate credit profile.

How often do creditors report to credit bureaus?

Creditors typically report account activity to credit bureaus once a month, though the timing may vary, resulting in potential discrepancies among the bureaus.

What factors cause credit scores to fluctuate?

Credit scores fluctuate due to changes in credit card balances, new loans, hard inquiries, and updates to credit reports. It’s important to monitor these factors regularly to maintain a healthy score.

How can Dispute Beast help manage credit score updates?

Dispute Beast helps manage credit score updates by automating dispute letters for inaccuracies on credit reports and providing credit monitoring tools to track improvements. This ensures users can effectively manage and enhance their credit scores.