Credit inquiries are one of the most misunderstood parts of credit scoring. People often hear, “Don’t let too many lenders check your credit,” while others claim inquiries don’t matter at all. The truth lies somewhere in the middle — and understanding soft vs hard inquiries is essential if you want to avoid unnecessary score drops in 2026.

In this guide, you’ll learn:

- The exact difference between soft and hard inquiries

- Which inquiries hurt your credit score (and why)

- How lenders interpret these inquiries during applications

- How long inquiries stay on your report

- When an inquiry is harmless — and when it’s a red flag

If you want a deeper technical breakdown of inquiry timelines, check the educational pillar here: How long do hard inquiries stay on your credit report.

What Is a Soft Credit Inquiry?

A soft inquiry — also called a “soft pull” — is a credit check that does not affect your credit score. Soft pulls are used for informational or promotional purposes and don’t signal any credit-seeking behavior to lenders.

Common examples include:

- Checking your own credit score

- Pre-approved credit card offers

- Background checks for employment

- Identity verification checks

- Account reviews from existing lenders

Soft inquiries appear on your personal credit report but are not visible to lenders. That means:

- They do not impact credit decisions

- They do not lower your score

- They do not show risk-seeking behavior

Soft pulls are also unlimited — you can check your score every day if you want, and nothing will happen to your credit.

What Is a Hard Credit Inquiry?

A hard inquiry — or “hard pull” — happens when a lender reviews your full credit file as part of a credit application. Because this signals potential new debt, hard inquiries can impact your score and your approval odds.

Typical hard inquiry triggers include:

- Applying for a credit card

- Getting a car loan

- Applying for a mortgage

- Requesting a personal loan

- Opening certain utility or telecom accounts

Unlike soft pulls, hard pulls are visible to lenders. Too many in a short period can make you look desperate for credit or financially unstable.

The CFPB’s official definition of credit inquiries confirms that hard inquiries reflect credit-seeking behavior lenders evaluate carefully.

How Much Does a Hard Inquiry Affect Your Score?

A single hard inquiry typically lowers your FICO score by 3–7 points. The impact depends on:

- Your existing credit history

- Your number of recent inquiries

- Your age of credit

- Your overall risk profile

For someone with a strong credit profile, one inquiry is insignificant. For someone with limited history or multiple recent applications, another inquiry can create noticeable score volatility.

It’s important to note:

- Hard inquiries affect your score for 12 months

- They stay on your report for 24 months

Lenders typically care about the last 6–12 months the most.

Why Hard Inquiries Exist (and Why They Matter)

Hard pulls act as a risk signal. When lenders see multiple inquiries in a short period, they worry you might be:

- Credit shopping aggressively

- Experiencing financial stress

- Planning to take on high levels of new debt

- Filling multiple applications hoping one gets approved

This is why timing and strategy matter for every credit application. Hard inquiries don’t hurt you much individually — but patterns matter a lot.

Do All Hard Inquiries Hurt Your Score the Same?

No. Credit scoring models have become smarter in the last few years. In fact, newer models treat certain inquiries differently to avoid penalizing normal consumer behavior.

For example:

- Rate shopping inquiries (mortgages, auto loans, student loans) within a specific window are treated as ONE inquiry.

- Business credit pulls may not show on personal reports depending on lender.

- Utility inquiries are often considered low-risk.

The FICO inquiry guidelines explain how scoring windows work for rate shopping — usually 14–45 days depending on the model.

How Soft Inquiries Affect Lenders’ Decisions

Even though soft pulls don’t affect your score, they still have important uses:

- They allow lenders to pre-screen customers

- They help companies verify identity quickly

- They allow you to monitor your own report without penalty

But lenders do not see your soft inquiries when reviewing your application. That means they cannot impact approval odds — positively or negatively.

How Hard Inquiries Affect Lenders’ Decisions

Lenders examine:

- How many inquiries you’ve had recently

- What types of inquiries they were

- Whether they indicate risk or instability

For example:

- 1–2 inquiries in the last year → Normal

- 4–6 inquiries in 90 days → Medium risk

- 8+ inquiries in 6 months → High risk

Even if your score is high, excessive inquiries may cause an automatic denial because lenders see instability behind the scenes.

Can You Dispute Hard Inquiries?

YES — but only under certain conditions.

You can dispute inquiries that are:

- Unauthorized

- Fraudulent

- Incorrectly listed

- Duplicated

But you CANNOT dispute hard inquiries that are legitimate. If you applied for credit, the inquiry is valid, even if you were denied.

For deeper guidance on this, see this resource: How to dispute a hard inquiry.

Soft vs Hard Inquiry: How They Impact Your Score (Side-by-Side)

| Factor | Soft Inquiry | Hard Inquiry |

|---|---|---|

| Impacts Credit Score? | No | Yes (3–7 points) |

| Visible to Lenders? | No | Yes |

| Generated When? | Checking score, pre-approvals, identity checks | Applying for new credit |

| Removal Possible? | No need | Only if unauthorized |

| How Long They Stay? | Not relevant | 24 months (score impact for 12 months) |

What Lenders Actually Care About When Reviewing Inquiries

Lenders don’t just look at whether you have inquiries — they evaluate patterns.

1. Timing Patterns

Multiple inquiries within days suggest instability or aggressive credit seeking.

2. Type of Inquiries

Mortgage inquiries are seen differently than credit card inquiries.

3. Combined Risk Profile

Inquiries paired with high utilization or recent late payments raise more flags than inquiries alone.

4. Inquiry-to-Approval Ratio

Too many inquiries with few new accounts = high risk.

When Hard Inquiries Become a Problem

Hard inquiries matter most when you:

- Have limited credit history

- Apply for multiple credit cards in a short period

- Have recent negative items

- Are rate shopping incorrectly (outside window)

Inquiries are rarely the sole reason for denial, but they often function as the tiebreaker when your profile is borderline.

How to Avoid Unnecessary Hard Inquiries

✔ Use pre-qualification tools

Many lenders let you check eligibility using soft pulls only.

✔ Keep applications spaced out

90 days is a safe minimum window between credit card apps.

✔ Avoid applying when utilization is high

Lenders are stricter when you already appear to be using too much available credit.

✔ Only apply when you truly need the credit

This avoids unnecessary score drops and lender red flags.

What to Do If You See Hard Inquiries You Don’t Recognize

This is where inquiries become serious. Unauthorized inquiries may indicate:

- Identity theft

- Application fraud

- Mixed credit files

- Incorrect reporting

The FTC’s identity theft portal recommends acting immediately when unauthorized inquiries appear.

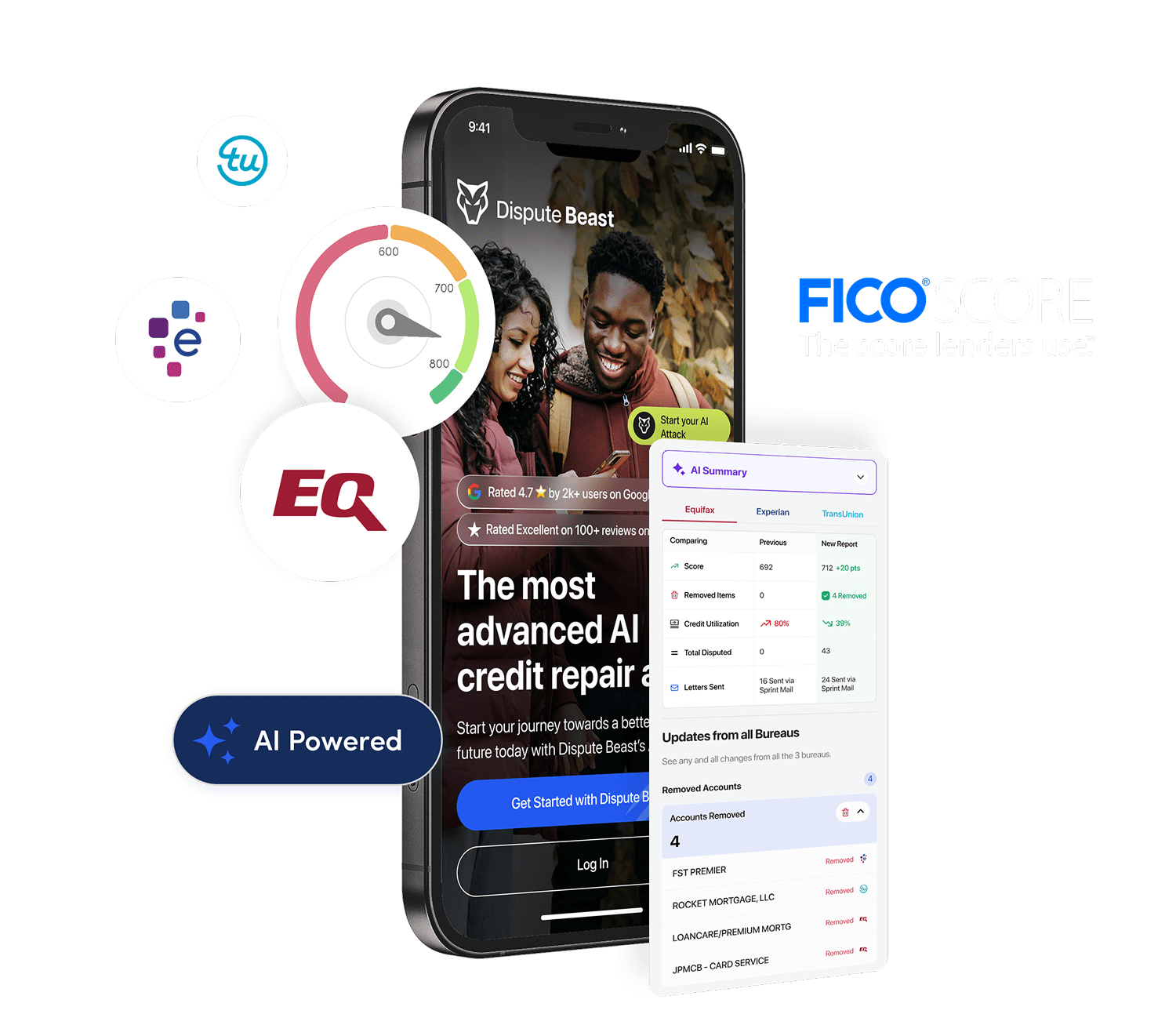

And here’s where Dispute Beast becomes invaluable:

How Dispute Beast Helps Remove Unauthorized Hard Inquiries

Dispute Beast automatically identifies:

- Incorrect inquiries

- Unauthorized pulls

- Duplicated inquiries

- Fraud-related inquiries

Then it generates dispute letters targeted at:

- The credit bureaus

- The data furnisher (the company that pulled your credit)

All in one click — and in full compliance with FCRA and Metro 2 guidelines.

So while hard inquiries should not be disputed just to improve your score, unauthorized inquiries should always be challenged.

Final Thoughts: Soft vs Hard Inquiries Don’t Matter the Same — But Both Matter

Soft pulls are harmless. Hard pulls matter only in patterns. Unauthorized inquiries matter immediately.

The more you understand how inquiries work, the better you can plan your applications and avoid unnecessary score drops.

And if you find any inquiry that shouldn’t be on your report, Dispute Beast automates the entire dispute process with accuracy, compliance, and bureau-specific targeting.

Understanding inquiries is the first step. Removing the wrong ones is the final step.