If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

When you apply for a loan, credit card, or mortgage, lenders check your credit report through what’s known as a hard inquiry. These checks can impact your credit score, so it’s essential to understand how they work and how long they stay on your report.

What Are Hard Inquiries?

Hard inquiries, also known as hard pulls, occur when a financial institution checks your credit report to make a lending decision. Unlike soft inquiries, which happen when you check your credit or when a company checks your credit for pre-approval offers, hard inquiries can slightly lower your credit score.

How Long do Hard Inquiries Stay on Your Credit Report

Did you know hard inquiries stay on your credit report for up to two years? But don’t worry—according to FICO®, they usually only affect your score for the first year. Imagine a slight dip in your score that slowly rebounds as you manage your credit wisely. By understanding this, you can plan your credit applications more strategically.

The Impact of Hard Inquiries on Your Credit Score

The impact of a hard inquiry on your credit score is relatively minor. Typically, each inquiry might lower your score by about five points. The exact effect depends on your overall credit profile. The impact may be even less for those with a robust credit history. It’s important to note that multiple hard inquiries in a short period can signal to lenders that you’re seeking numerous new credit accounts, which might raise concerns about your financial stability.

READ ME NEXT: Take charge of your credit with our easy 11-step guide! Learn how to fix your credit yourself, save money, and avoid costly services. Ready to start? Click here to read the guide for free!

Rate Shopping & Hard Inquiries

If you’re shopping around for the best mortgage or auto loan rates, multiple inquiries within a specific period (usually 14 to 45 days) are typically counted as a single inquiry by credit scoring models like FICO®. This practice helps minimize the negative impact on your credit score while you compare rates.

Monitoring Your Credit For Hard Inquiries

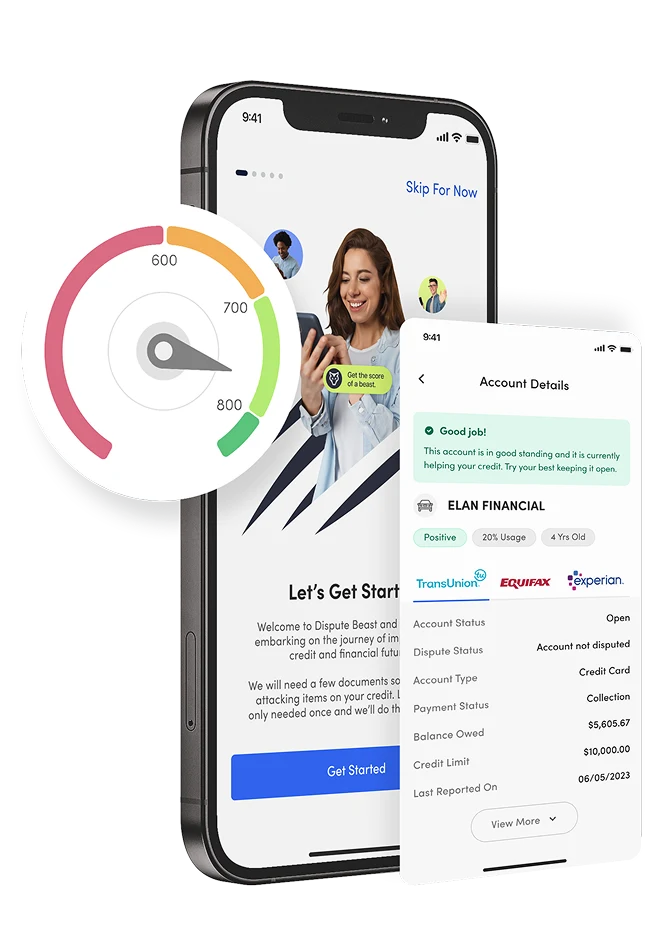

Keeping track of your credit is crucial. Beast Credit Monitoring is the best option for monitoring your credit. With a subscription to Beast Credit Monitoring, you also get complimentary access to Dispute Beast, allowing you to attack all negative items on your credit report with a button, including those pesky hard inquiries.

How To Remove Hard Inquiries from Credit Report

Suppose you find a hard inquiry on your credit report that you believe is incorrect or the result of identity theft. You can dispute it with the credit bureau reporting the information in that case. If the inquiry is found to be unauthorized or erroneous, it will be removed from your report. Here are some screenshots from Dispute Beast on how to attack inquiries:

Avoid Challenging Certain Hard Inquiries

Be cautious about challenging hard inquiries associated with an open revolving account, such as a credit card, as this may trigger the issuer’s closure of the account. Ensure you only dispute inquiries that are not linked to active accounts to avoid unintended consequences.

Final Thoughts About Hard Inquiries

Hard inquiries are a necessary part of the credit application process, but understanding their impact can help you manage your credit more effectively. You can maintain a healthy credit score by being mindful of how often you apply for new credit and monitoring your credit reports regularly.

Ready to Take Control of Your Credit?

Monitor your credit and manage your financial health with Beast Credit Monitoring and Dispute Beast, the world’s most advanced and effective DIY credit repair software. Whether you’re applying for a new credit card or planning a major purchase, knowing how hard inquiries work and their impact can empower you to make informed financial decisions.

FREE RESOURCE: Boost your credit score with our Ultimate Guide to DIY Credit Repair! Discover 11 simple steps and how Dispute Beast can empower you to take control of your credit. Ready to improve your financial health? Click here to learn more!

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!