The credit repair industry has changed more in the last three years than in the previous three decades. Artificial intelligence has transformed how consumers detect errors, generate disputes, and track results—making template-based credit repair obsolete in 2026. While templates were once the default approach for millions of people trying to fix their credit, they no longer match the accuracy, speed, or compliance capabilities of modern AI-driven platforms.

In this deep-dive, you’ll learn exactly why AI credit repair works dramatically better than templates, how automated technology improves success rates, and why consumers are shifting to intelligent systems like Dispute Beast. If you’re serious about repairing your credit in 2026, this guide will show you the fastest and most compliant path forward.

We’ll also link to foundational resources so you can understand how AI fits into the broader dispute ecosystem—including the complete AI credit dispute workflow and the pillar guide on How to Repair Credit Fast: A Step-by-Step Guide to Getting Back on Track.

AI Credit Repair vs. Templates: What Changed in 2026?

For years, templates dominated credit repair. They were easy, accessible, and widely shared online. But in 2026, credit bureaus and furnishers strengthened their fraud detection systems, making template letters significantly less effective. Automated detection tools can now identify repeated language, boilerplate disputes, and mass-produced requests.

This shift forced a change: consumers needed a more sophisticated method—one that adapts to their unique credit file and avoids triggering automated rejections.

That’s where AI took over.

How AI Credit Repair Works on a Technical Level

AI Scans the Credit Report for Hidden Errors

Unlike templates, AI analyzes the structure and data of each credit report line-by-line. Using natural language processing and pattern recognition, AI detects inconsistencies across:

- payment history fields

- open/close dates

- balance updates

- account ownership information

- data furnisher reporting patterns

- Metro 2 compliance formatting

AI can also identify issues before users ever notice them. For example, it can detect utilization inconsistencies using logic similar to Experian’s credit utilization scoring guidelines or compare reporting patterns across bureaus to uncover duplicate tradelines.

Templates Cannot Detect or Classify Errors

Templates only challenge items the user manually chooses. If you don’t identify the error, the template won’t either. This is one of the biggest weaknesses of template-based credit repair—your success depends entirely on what you notice yourself.

AI removes guesswork by surfacing dozens of issues that templates overlook.

AI Builds Personalized, Compliance-Based Disputes

Why Personalization Matters in 2026

Bureaus have evolved. Automated systems compare dispute letters against databases of known templates. If a template pattern is detected, the investigation may be shortened or dismissed due to insufficient specificity.

AI solves this problem by generating 100% unique, personalized letters tailored to:

- the specific error being disputed

- Metro 2 violation indicators

- the reporting history of the data furnisher

- the user’s updated credit report

This level of personalization cannot be achieved with templates—even “advanced” templates found online.

Data Furnishers Respond Better to AI-Generated Disputes

AI Includes Precise, Factual Claims

Data furnishers (banks, lenders, collectors) respond more effectively to factual, detailed, high-accuracy disputes. AI can automatically reference:

- Account numbers

- Reported dates

- Status inconsistencies

- Balance discrepancies

- Historical reporting inconsistencies

This precision aligns with the expectations detailed in the CFPB’s Regulation V accuracy obligations. Templates lack this level of detail and often fail to present a clear factual basis.

AI Credit Repair Works Faster Than Templates

Templates Take Days — AI Works in Seconds

Template users often spend hours:

- reviewing their report manually

- typing out letters

- editing template language

- deciding which items to dispute

AI replaces all of this instantly:

- scanning: seconds

- error detection: seconds

- drafting letters: seconds

- classification: seconds

Most users complete their entire dispute round in under 10 minutes.

And because the entire process is automated, users repeat this cycle every 40 days—matching the recommended interval found in many credit reporting analyses including NerdWallet’s credit investigation timelines.

AI Avoids the Most Common Template Mistakes

Templates Trigger Automated Bureau Systems

Credit bureaus receive millions of disputes per month. Many templates contain identical language, formats, and claims—making them easy for automated systems to detect and deprioritize.

Bureaus aren’t ignoring you—they simply know it’s a template and treat it accordingly.

AI Ensures Every Letter Is Unique

AI-generated letters use unique formatting, phrasing, factual references, and even varied fonts (a strategy built directly into Dispute Beast). This diversity makes it nearly impossible for bureaus to classify them as low-value template disputes.

AI vs Templates: Success Rates in 2026

Error Types Where AI Performs Better

- duplicate accounts

- incorrect balance reporting

- outdated payment history

- mixed credit file issues

- re-aged debt

- unauthorized inquiries

AI quickly identifies and challenges these errors with compliance-based precision.

Error Types Where Templates Fail Completely

- complex reporting inconsistencies

- Metro 2 formatting violations

- cross-bureau data mismatches

- furnisher-specific reporting patterns

Templates lack the analytical ability to understand these issues, much less challenge them.

AI Dispute Workflows Are More Compliant

AI Ensures Every Letter Follows Federal Guidelines

AI-generated letters incorporate compliance standards from:

- FCRA

- FDCPA

- Metro 2 guidelines

- Case law references

Templates, by contrast, often cite laws incorrectly or use outdated language. This can weaken investigations or cause disputes to be flagged.

For example, many templates incorrectly quote the 30-day timeline—something clarified clearly in the FTC’s FCRA rule documentation.

AI Credit Repair Builds Better Attack Cycles

AI platforms like Dispute Beast automate the 40-day attack cycle:

- scan report

- detect errors

- draft letters

- track results

- repeat

This continuous improvement loop is what allows users to achieve long-term improvements—similar to how fitness progress is made through consistent cycles, not one-time effort.

For a full breakdown of how this cycle works, review the complete AI credit dispute workflow.

Internal Linking: Strengthening Your Repair Strategy

If you’re looking to build a complete repair plan in 2026, start with the foundational guide:

How to Repair Credit Fast: A Step-by-Step Guide to Getting Back on Track.

Why Templates Will Continue to Decline in 2026

Bureaus Are Cracking Down

Credit bureaus and furnishers have invested heavily into automated mismatch detection—similar to plagiarism scanners used in academia. Template letters are now easily identified and deprioritized.

AI Is Now Easier Than Templates

Ironically, the biggest shift is convenience. Templates used to be “the easy way.” But in 2026, AI is actually easier, faster, more compliant, and more effective.

How Dispute Beast Uses AI to Replace Templates Entirely

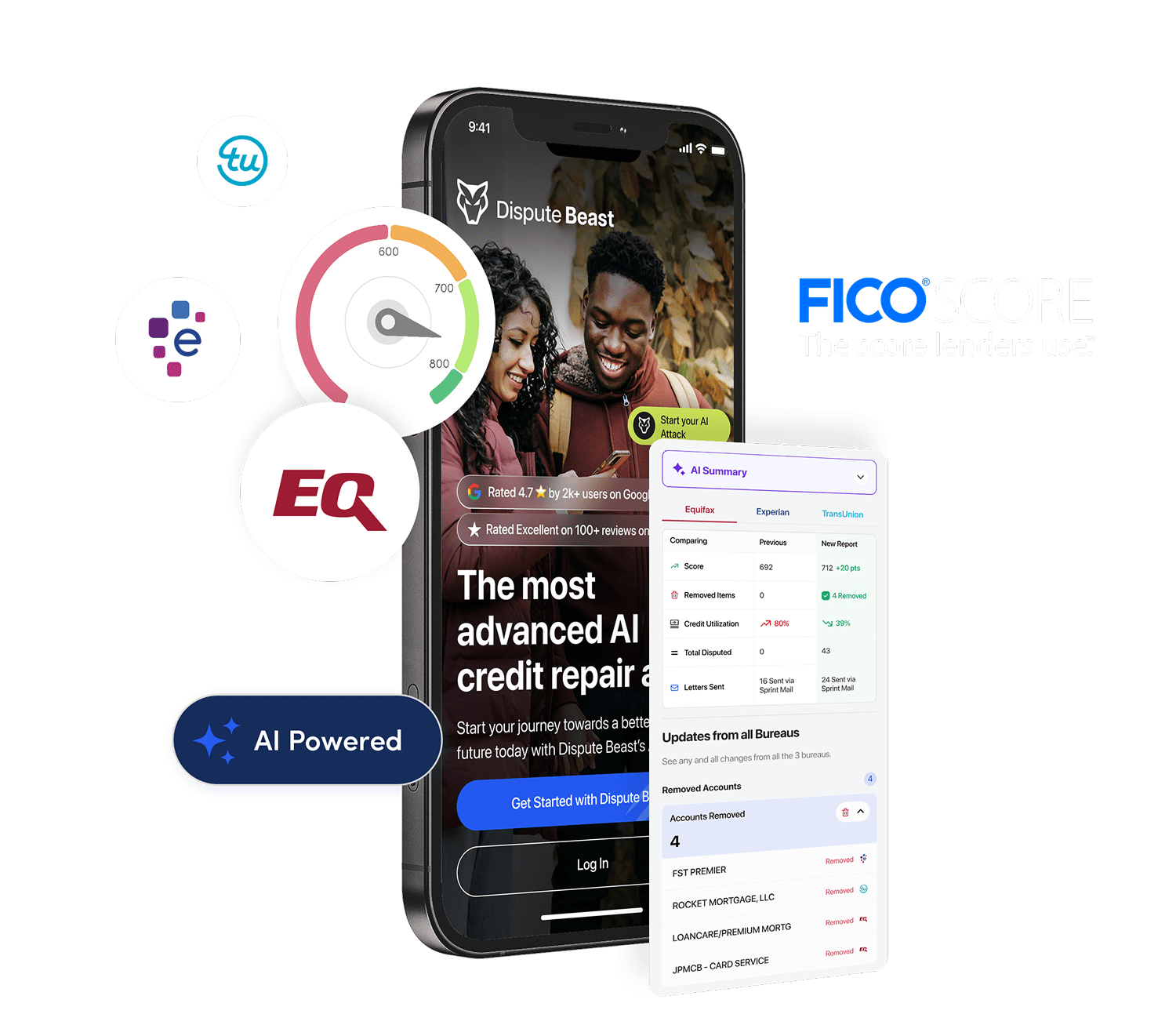

Dispute Beast integrates every advantage of AI credit repair into one platform:

- AI error scanning

- AI dispute classification

- AI-generated compliance-based letters

- 40-day automated cycles

- integration with FICO 8 and Vantage 3.0 monitoring

The software is free with ongoing credit monitoring—making it more affordable than traditional credit repair or template bundles.

If you’re ready to replace templates with next-generation automation, start your free Dispute Beast account today and launch your AI-powered attack cycle with a single click.