If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

Hey there! So, you’re ready to dive into credit repair with Dispute Beast? Awesome! When it comes to mailing out those letters for the best results, here’s what you need to know.

Preparing Your Dispute Letters

First and foremost, it’s essential to send out all the letters generated by Dispute Beast. Don’t leave any letters in your queue; each one represents a step toward improving your credit. For best practices, use separate envelopes for each letter to ensure that each dispute is handled as an individual case. Simply print these letters in black and white, and double-sided printing will suffice—there’s no need for signatures.

Mailing Strategies

When it comes to sending out your letters, opt for first-class postage. This method is cost-effective and reliable. While some might consider using certified mail to ensure delivery, it’s not necessary to incur this additional expense. Your primary goal is to ensure that the letters reach their destinations so that the dispute process can begin.

The Multi-Level Attack Plan

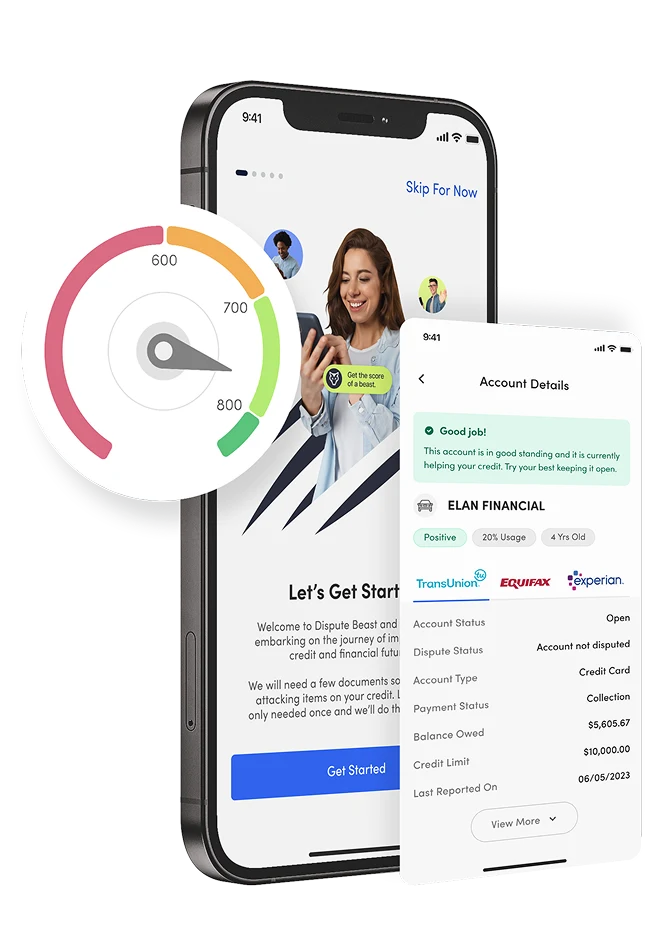

Dispute Beast doesn’t just send disputes to the three major credit bureaus; it takes a comprehensive approach by also targeting secondary bureaus and data furnishers. This extensive coverage ensures that all bases are covered, improving the likelihood of favorable outcomes from your disputes.

FREE RESOURCE: Boost your credit score with our Ultimate Guide to DIY Credit Repair! Discover 11 simple steps and how Dispute Beast can empower you to take control of your credit. Ready to improve your financial health? Click here to learn more!

Save on Mailing Costs

Here’s a valuable tip: save the money you would have spent on certified mail and instead use it towards reducing your debts or increasing your savings. Managing your finances wisely during your credit repair journey is crucial for long-term success.

Continuous Monitoring and Consistency

While engaging in this process, keep your Beast Credit Monitoring active. This tool will help you track changes and improvements in your credit score, providing real-time feedback on the effectiveness of your efforts. Consistency is key—commit to sending out dispute letters and monitoring your credit for 6 to 12 months. It is during this period that many see significant improvements in their credit scores.

Stay the Course

Credit repair is not an overnight fix. It requires persistence and consistent effort. By regularly updating your disputes, monitoring your credit, and adjusting your approach based on what’s working, you can drive substantial improvements in your financial profile.

By following these steps and maintaining a disciplined approach to your credit repair strategy with Dispute Beast, you’re setting yourself up for success. Remember, every letter sent is a step closer to achieving the credit score you deserve. You’ve got this!

READ ME NEXT: Take charge of your credit with our easy 11-step guide! Learn how to fix your credit yourself, save money, and avoid costly services. Ready to start? Click here to read the guide for free!

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!