When you apply for a mortgage, auto loan, credit card, or personal loan, lenders aren’t guessing. They follow a structured underwriting process built around your credit report, credit score, payment behavior, utilization, inquiries, and risk patterns. What many consumers don’t realize is that your credit disputes—past or ongoing—can significantly impact that decision.

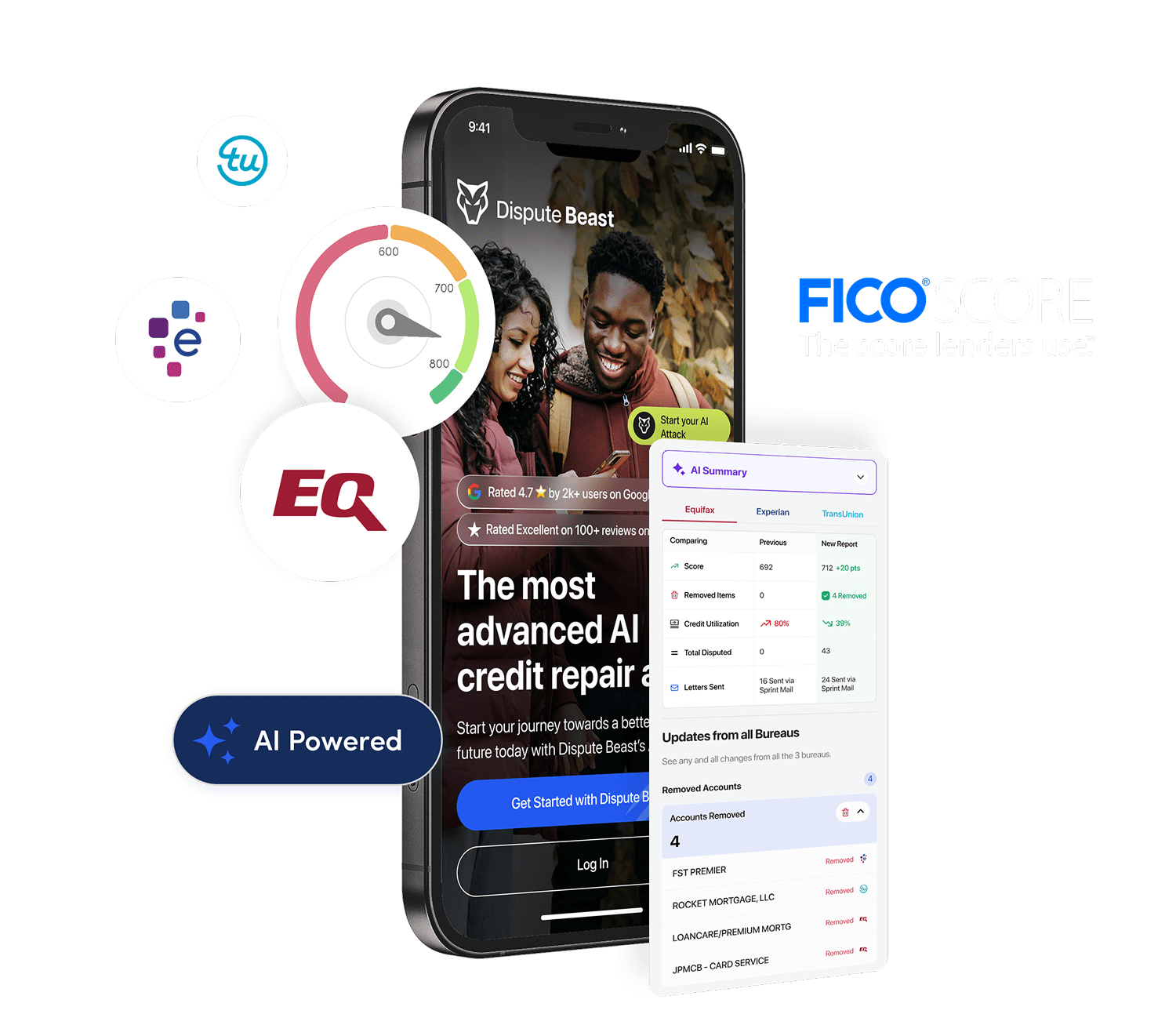

This guide breaks down exactly what lenders see, how they interpret each factor, and how the strategic use of credit disputes can improve your approval odds and interest rates. And because 2026 lending is more automated than ever, we’ll also cover how AI-powered dispute tools like Dispute Beast help optimize your credit profile before lenders even review it.

Before diving in, if you need fast-score optimization tips, review our guide on how to raise credit scores quickly.

What Lenders Actually Look At (Behind the Scenes)

Underwriting systems evaluate your credit file in layers. While every lender uses slightly different scoring overlays, most rely on FICO 8, FICO 10, or industry-specific versions such as FICO Auto Score or FICO Mortgage Score.

1. Payment History

This is the single most important factor in every scoring model. Lenders review:

- Late payments (30, 60, 90+ days)

- Charge-offs

- Collections

- Bankruptcies

- Current vs. past delinquencies

Even one late payment can drop a score 50–110 points depending on the profile. This is why disputing inaccurate late payments can dramatically improve your approval odds.

2. Credit Utilization

Lenders analyze how much of your revolving credit you’re using. Utilization factors heavily into approval decisions because high usage signals financial stress.

For context, Experian outlines how utilization impacts scoring in its credit utilization guide.

Disputing incorrect balances or limit reductions can reduce your utilization instantly and change your risk classification.

3. Length of Credit History

Lenders want to see long-standing accounts with consistent payment behavior. Even if your score is strong, a thin profile can trigger denials or higher rates.

4. Credit Mix

Diverse accounts—installment loans, revolving accounts, auto loans, mortgages—demonstrate you can handle different types of credit responsibly.

5. Hard Inquiries

Every hard pull is a signal to lenders. Too many clustered inquiries often show:

- Credit shopping

- Potential risk-taking

- Possible financial instability

If you suspect unauthorized inquiries, see our guide on how to dispute hard inquiries.

6. Derogatory Marks

This includes charge-offs, collections, liens, judgments, and bankruptcies. These marks often automatically disqualify borrowers from premium credit products.

How Disputes Change the Way Lenders See You

Contrary to popular belief, lenders can see disputes. And depending on timing and account type, disputes can either help you or temporarily pause underwriting.

Dispute Status Codes — What Lenders See in Their System

When you dispute an account, the bureaus add a compliance-based code such as:

- XB — Consumer disputes account

- XC — Consumer disputes account, investigation in progress

- XH — Dispute resolved, consumer disagrees

Mortgage lenders specifically cannot issue a final approval on certain accounts with active dispute codes. Auto lenders and credit card issuers are more flexible but still review dispute status carefully.

Why Some Lenders Pause Applications During Disputes

Certain account types—especially late payments, charge-offs, and collections—cannot remain in a dispute state during underwriting. Lenders need the bureau data to be “final” before evaluating risk.

This is why dispute timing matters. Starting disputes right before a mortgage application can delay approval by weeks.

How a Successful Dispute Improves Approval Odds

Removing inaccurate items can dramatically reshape your risk category. Here are the most impactful dispute outcomes lenders look at:

1. Removal of Late Payments

Late payments are one of the biggest predictors of default. Eliminating even one inaccurate late payment can:

- Increase your score 50–110 points

- Move you into a better approval tier

- Reduce your interest rate significantly

2. Correcting High Balances or Limits

Incorrect balances inflate your utilization. Fixing these errors improves:

- Risk category

- Interest rate eligibility

- Credit card approval odds

3. Removing Duplicate Accounts

Duplicate negative accounts double-penalize your score. Lenders treat this as a major red flag.

4. Eliminating Fraudulent Accounts or Inquiries

Fraud signals potential instability and identity issues. Cleaning these from your report is essential before major applications.

What Lenders See Beyond Your Credit Report

Lenders also evaluate additional factors that consumers often overlook:

- Your income vs. debt ratios

- Your employment history

- Your recent financial activity

- Bank statements

- Your credit behavior trends over the past 24 months

They’re looking for stability—consistent behavior that resembles the patterns of borrowers who rarely default.

How AI Improves Your Chances Before You Apply

2026 lenders are increasingly leveraging automated underwriting systems (AUS). AI-powered credit repair platforms like Dispute Beast help get your profile “AUS-ready” before you apply.

AI Helps You Identify High-Risk Patterns

AI scans for discrepancies and high-risk items, such as:

- Late payments harming your FICO tiers

- Utilization spikes causing short-term drops

- Inquiries that appear clustered or excessive

- Mismatched dates that can trigger auto-denials

AI Prioritizes Which Items to Fix First

Instead of disputing everything randomly, AI highlights:

- Which items are harming your score the most

- Which items lenders care about the most

- What can be corrected fastest

This targeted approach delivers faster and more meaningful improvements.

AI Removes Human Guesswork in Dispute Language

AI platforms generate compliance-based dispute letters using:

- FCRA regulations

- Metro 2 standards

- Case law patterns

This dramatically improves the chances of successful dispute outcomes.

To understand the full workflow, see our guide on AI credit dispute processes.

The Impact of Disputes on Mortgage, Auto, and Credit Card Applications

Mortgage Applications

Mortgage lenders are the strictest. Active disputes on key accounts can pause underwriting until the dispute is resolved. This is why strategic timing is essential.

Auto Loans

Auto lenders rely on industry-specific FICO scores that often weigh recent auto loan history more heavily. Disputes can still help remove inaccurate delinquencies or inquiries that harm those scores.

Credit Cards

Credit card issuers primarily focus on utilization, recent inquiries, and overall risk. Disputes that correct balances or eliminate errors can dramatically increase approval odds.

How to Prepare Your Credit Before Applying

1. Run an AI-Based Scan

This identifies everything lenders will analyze—before they see it.

2. Dispute All High-Impact Errors

Focus on late payments, duplicate accounts, wrong balances, and unauthorized inquiries.

3. Optimize Your Utilization

This is one of the fastest ways to increase your approval odds.

4. Avoid New Inquiries

Every new inquiry lowers your score slightly and signals risk.

5. Ensure No Active Dispute Codes Are Present Before a Mortgage Application

Active disputes can pause or cancel underwriting.

How Dispute Beast Strengthens Your Application

Dispute Beast uses AI to audit your credit report, identify scoring issues, auto-generate dispute letters, and walk you through every step of cleanup before lenders enter the picture.

It analyzes your credit file every 40 days and sends out new dispute rounds automatically, helping you build long-term credit stability that lenders trust.

Final Thoughts: Lenders Don’t Guess — They Evaluate

Understanding what lenders see is one of the most powerful steps you can take before applying for new credit. Each dispute you file, each correction you make, and each optimization you implement directly influences how lenders categorize your risk.

If you want to take control of how lenders see you, start by analyzing your credit report the way their systems do. Use AI tools, identify errors, correct them fast, and position your profile for the strongest possible approval outcome.