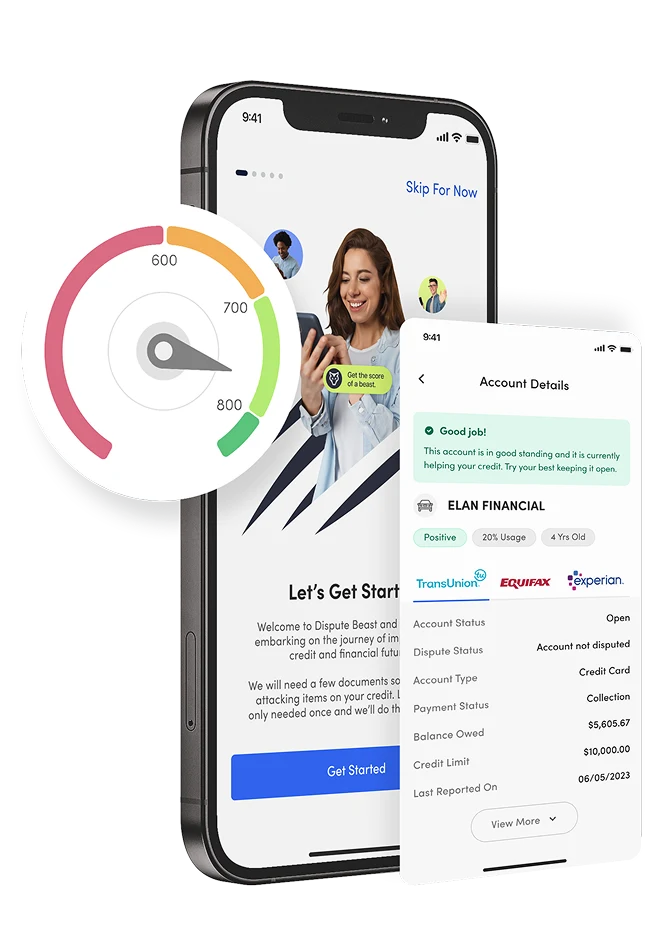

If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

Don’t Let Stall Tactics Discourage You:Stay Consistent, Ignore Them, and Send a Minimum of 4 to 6 Attacks for the Best Results! ![]() Important Update from Dispute Beast!

Important Update from Dispute Beast!

We understand that you might receive automated stall emails or letters from credit bureaus, data furnishers, or secondary bureaus. These are common tactics used to discourage you from attacking and fixing your credit. They may even claim that the letter doesn’t appear to be from you, despite you creating the attack yourself.

Why do they do this? Because investigating disputes costs them millions of dollars each year. Even when they state they won’t investigate, they often still do, and you can still achieve deletions.

Here’s what you need to know:

1. No Action Needed: When you receive these stall letters, there’s no need to do anything. You’ve provided sufficient details and identification to verify yourself, and you’ve created the letters.

2. We Anticipate Their Moves: Every Dispute Beast attack includes a paragraph acknowledging that we are aware of their automated stall letters.

3. Next Steps: Simply ignore their response. When it’s time for your next attack, if the item is still on your credit report, Dispute Beast will handle it differently in the next round.

4. Timing is Key: Do not send another dispute before 30 or 40 days have passed. According to the FCRA, if you respond or send another dispute before this period, you give them extra time to investigate.

5. Consistency is Crucial: Judge your results after 4 to 6 attacks. You might receive multiple stall letters per round, but remember, it’s all part of the process. Stay consistent and patient.

Even when you receive these stall letters, rest assured that they are still investigating. Do not give up. Trust the process, and let Dispute Beast guide you every step of the way.

Stay determined and focused on your credit repair journey!

P.S. The photos below are one of hundreds of different stall letters.

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!