If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

When improving your credit report by getting deletions, many people wonder if they need to opt-out or freeze their accounts with secondary consumer reporting agencies. The straightforward answer is no; you do not have to opt out or freeze any of these bureaus. The opt out process for prescreened offers typically involves submitting an opt out request online through an official website or site, by phone, or by mail. Instead, the most effective approach is to attack the negative information directly.

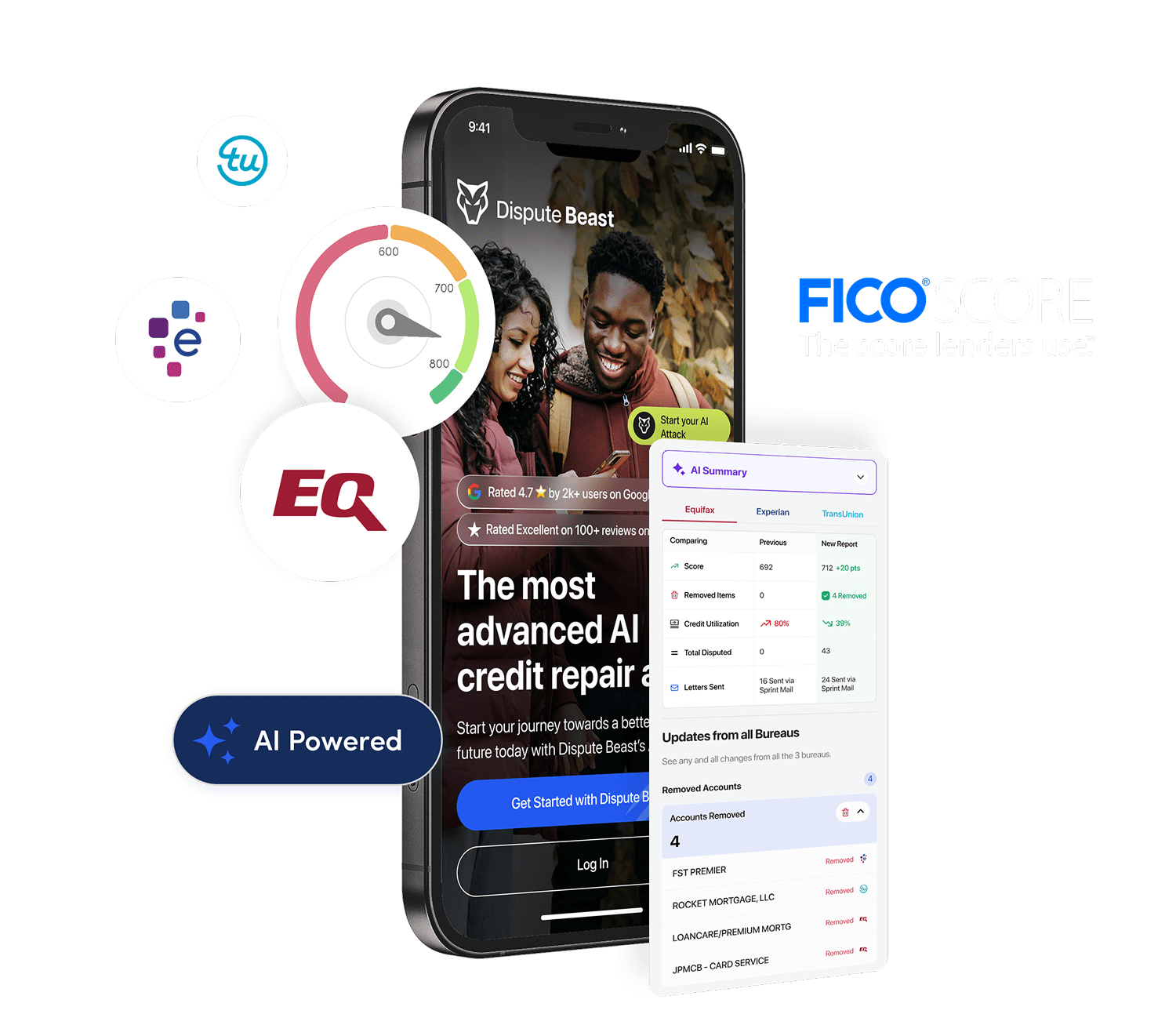

In this blog, we’ll explore why opting out and freezing your credit is unnecessary for deleting negative items and explain how Dispute Beast can help you achieve your credit repair goals efficiently with just one button press.

When improving your credit report by getting deletions, many people wonder if they need to opt out or freeze their accounts with secondary consumer reporting agencies. The straightforward answer is no; you do not have to opt out or freeze any of these bureaus. Let’s explain why this is the case and the best course of action for achieving your credit repair goals. You can opt out for five years or permanently, and opt out requests are often processed immediately or within five days.

If you do choose to opt out, the opt out process may require you to fill out a form or send a written request, and you may need to confirm your request via the official website or site. You can also opt out by phone or mail, and the process can cover not only credit reports but other types of consumer reports, such as utility and insurance reports.

These businesses and companies collect and share various types of consumer data, which is why understanding your options for managing your information is important.

Introduction to Credit Reporting

Credit reporting plays a vital role in your financial life, shaping the way creditors view your creditworthiness and influencing your ability to qualify for loans, credit cards, and even some jobs. The three major credit bureaus—Equifax, Experian, and TransUnion—collect and maintain detailed records of your credit accounts, payment history, and public records. This information is compiled into credit reports, which creditors use to assess your reliability as a borrower.

By regularly reviewing your credit reports, you can spot errors, track your payment history, and ensure that all accounts listed are accurate. Monitoring your credit reports is also one of the best ways to protect yourself from identity theft, as it allows you to quickly detect any unfamiliar accounts or suspicious activity. Understanding how credit reporting works empowers you to take control of your financial health and safeguard your identity.

Understanding Opt-Outs and Freezes

Opt-Out: Opting out refers to removing yourself from mailing lists that credit bureaus use to send firm offers of credit or insurance to customers. Companies and credit bureaus are sending prescreened offers to customers based on their credit reports, and opting out helps reduce the number of these pre-approved credit offers you receive. To complete the opt-out process, you may need to register on the official site and provide information such as your driver’s license and date of birth. You can visit or contact the opt-out website to manage your preferences, and visiting the site is required to complete the process. Opting out does not affect the data these agencies collect or share about you for credit reporting purposes.

Freeze: A security freeze, also known as a credit freeze, is a measure you can take to restrict access to your credit report. Freezing your report prevents the creation or release of new credit reports to unauthorized parties. LexisNexis states, “The security freeze is designed to prevent credit, loans, and services from being approved in your name without your consent. However, a security freeze does not apply to companies or collection agencies acting on behalf of companies with which you have an existing account requesting information in your consumer report to review or collect the account.”

READ ME NEXT:

- Take charge of your credit with our easy 11-step guide! Learn how to fix your credit yourself, save money, and avoid costly services. Ready to start? Click here to read the guide for free!*

Why Freezing Doesn’t Stop Information Sharing

A common misconception is that freezing your credit with secondary consumer reporting agencies will stop negative information from being shared. This is not true. A security freeze only prevents new creditors from accessing your credit report to open new accounts. Credit bureaus can still release or send your credit report to existing creditors or for requests related to existing accounts. Typically, a freeze does not prevent the release of your credit information to companies you already do business with, or for requests involving account review, collection, or fraud investigations. It does not stop existing creditors or collection agencies from reporting negative information to the credit bureaus. This means that even with a freeze in place, your credit report can still be updated with negative items from companies you already have accounts with. Fraud can still occur on existing accounts, so monitoring your accounts remains necessary.

Why Freezing Doesn’t Help with Deleting Negative Information

Freezing your credit does not impact the existing negative items on your report. It doesn’t lead to the deletion of negative information because it doesn’t address the root of the problem. The negative information remains in your credit report, accessible to any entity with permissible purpose under the Fair Credit Reporting Act (FCRA). Negative information can also come from other sources, such as groups or organizations that report to the credit bureaus. To remove negative items, you need to challenge the accuracy and validity of the information directly.

Note: A credit freeze does not prevent all types of fraud or identity theft, and it does not stop mailings addressed to ‘resident’ or unsolicited offers from certain groups. You may still receive prescreened offers or solicitations from other sources, including charities, professional groups, or businesses, and you will need to contact these groups directly to opt out.

Credit Bureau Regulations

Credit bureaus operate under strict regulations designed to protect consumers and ensure the integrity of credit reporting. The Fair Credit Reporting Act (FCRA) is the primary law governing how credit bureaus collect, maintain, and share your credit information. Under the FCRA, credit bureaus must ensure that your credit reports are accurate and complete, and they are required to provide you with access to your reports upon request.

If you find an error on your credit report, the FCRA gives you the right to dispute it and have the credit bureau investigate. Additionally, credit bureaus must obtain your consent before sharing your credit report with third parties, helping to protect your identity and limit unauthorized access. By understanding your rights under these regulations, you can better protect your credit and reduce the risk of identity theft.

Preventing Identity Theft

Protecting yourself from identity theft starts with limiting access to your credit reports and safeguarding your personal information. One effective step is to opt out of prescreened offers, which reduces the chances of your information being used for unsolicited offers or targeted by fraudsters. You can also freeze your credit, making it harder for unauthorized individuals to open new accounts in your name.

Be vigilant about protecting sensitive data like your social security number and driver’s license, and use strong, unique passwords for your online accounts. Regularly monitoring your credit reports allows you to quickly spot any suspicious activity or errors, and you should report any discrepancies to the credit bureaus immediately. By taking these proactive measures, you can help limit access to your credit file, reduce unwanted sales calls, and protect your identity from theft.

The Dispute Beast Approach

At Dispute Beast, we recommend a proactive strategy: attack the negative information. This involves challenging the accuracy and legitimacy of the negative entries with both the original creditor and the consumer reporting agencies. By questioning the validity of these entries, you can force the creditors and bureaus to provide evidence that the information is correct. If they fail to do so, the negative items must be removed from your report. Please note, you may need to pay for certain credit repair services or to access some credit reports during this process. You may also need to log in to an online portal to manage your disputes or to freeze or unfreeze your credit.

Our method is efficient and user-friendly. Dispute Beast initiates a comprehensive attack on the negative information affecting your credit score with just one button press. This streamlined process saves you time and ensures all necessary steps are taken to improve your credit monitoring information. In addition to protecting your own credit, consider safeguarding your child’s credit file as well. This may require providing a birth certificate or proof of birth to verify your child’s identity and prevent identity theft.

FREE RESOURCE:* Discover Why Dispute Beast is Your Ultimate Solution for Eliminating Negative Information. In this article, we reveal the powerful three-pronged attack strategy that Dispute Beast employs to deliver outstanding results. Click here to learn more!*

Conclusion

You need not opt-out or freeze your accounts with secondary consumer reporting agencies to achieve deletions. Instead, focus on attacking the negative information directly. Freezing your credit does not prevent negative data from being shared, nor does it help remove existing negative entries. Dispute Beast provides an effective solution by challenging the accuracy of the negative information on your credit report, all with the ease of a single button press. Take control of your credit today with Dispute Beast and start your journey toward a better credit score.

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!