If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

So you want to take control of your credit report and ensure that your personal information—like names and addresses—is up-to-date? In this article, we’ll walk you through 4 actionable steps to update or remove names and addresses from your credit report.

How Names and Addresses Get on Your Credit Report

Names and addresses are added to your credit profile when you apply for credit, like loans, credit cards, mortgages, or even utility services. Every 30-45 days, data furnishers (creditors) report your information to the credit bureaus (Equifax, Experian, and TransUnion).

Here’s why there might be variations:

• The way you fill out an application affects what gets reported. For example:

• First and Last Name vs. Full Name with a Middle Initial.

• Different address formats if you’ve moved frequently.

Old names and addresses remain on your credit report because they are part of the identifying data tied to your credit activity.

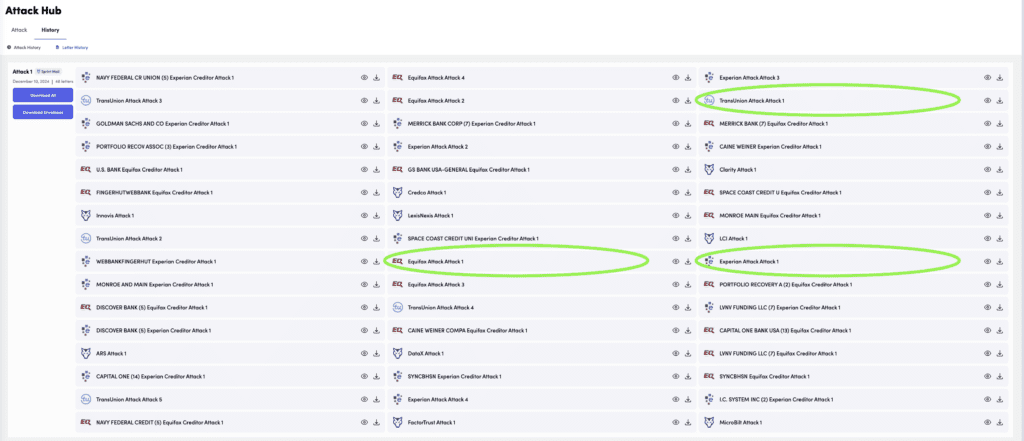

Step 1: Use Dispute Beast to Request Updates

Dispute Beast makes removing old names and addresses easy with its Letter 1, which specifically targets personal information like names and addresses. Here’s how it works:

1. Letter 1 is sent to Equifax, Experian, and TransUnion.

2. The letter includes the name and address you provided in your Dispute Beast profile.

3. It attaches 2-3 forms of ID (e.g., government-issued ID, utility bill, bank statement) to verify your information.

4. Dispute Beast partners with SprintMail to handle mailing the letters for you, so you don’t have to worry about postage or logistics.

5. Comprehensive Approach: Dispute Beast’s attacks are not limited to the credit bureaus. The platform also targets data furnishers (like creditors) and secondary bureaus, ensuring complete coverage of your credit needs.

Note: While personal information (name, address, employment) appears on your credit report, it has no impact on your credit score or the success of disputes. It is simply a form of identification.

Step 2: Update Information with Data Furnishers

Names and addresses on your credit report originate from the companies reporting your credit activity. To ensure accurate reporting:

1. Contact all your creditors where you are in good standing (e.g., credit card companies, mortgage providers, auto lenders).

2. Update your name and address on file with each of them.

3. When these companies report to the credit bureaus, the updated information will automatically replace outdated details.

Example: If you recently moved or got married, updating this information ensures consistency across your credit report.

Step 3: Contact the Credit Bureaus Directly via Phone

In addition to using Dispute Beast, you can call the credit bureaus directly to verify updates:

• Equifax: 1-888-548-7878

• Experian: 1-888-397-3742

• TransUnion: 1-800-916-8800

When you call, tell them you have already updated your addresses with all your creditors. This helps ensure the credit bureaus are aware that the correct information is now being reported by the data furnishers.

Important: Phone numbers for the credit bureaus may change over time. To ensure you have the most up-to-date contact information, always visit their official websites:

• Equifax: www.equifax.com

• Experian: www.experian.com

• TransUnion: www.transunion.com

Be ready to confirm your identity with supporting documents, such as a copy of your ID and a recent utility bill.

Step 4: Patience is Key

Credit bureaus maintain a history of all applications and data submitted to them. Over time, this results in a long list of names, addresses, and aliases tied to your profile.

Here’s the good news:

• Every time you create a Dispute Beast attack, Letter 1 automatically requests:

• Updates to your current name and address.

• Removal of outdated or incorrect information.

Consistency is key—stay patient as these changes may take a little time to reflect.

Why Accurate Personal Information Matters (and the Myths)

The Truth:

Your name and address have no impact on your credit score or your ability to dispute inaccurate items.

The Myth:

There’s a common belief that having perfectly accurate personal information makes it easier to remove negative items. This is false. Successful disputes are based on factual inaccuracies—not personal identifiers.

Updating your information is about organization and clarity, ensuring that creditors and credit bureaus report consistently and accurately.

Dispute Beast Reviews: Trusted by Thousands

Dispute Beast has earned near 5-star reviews from satisfied clients who have seen real results. Don’t just take our word for it—read what others have to say about their success stories with Dispute Beast.

👉 Click here to view Dispute Beast client reviews

Need Help? Contact Dispute Beast Support

If you have any questions, concerns, or need assistance along the way, our official Dispute Beast support team is here for you!

• Email Support: help@disputebeast.com

• Visit: https://disputebeast.com/help/support/

We’re committed to making your credit improvement journey as smooth and successful as possible.

Take the Next Step Today

Ready to take action? Dispute Beast makes credit improvement easy and effective with our user-friendly platform. Start your first attack and see the difference for yourself.

👉 Click here to visit the Dispute Beast Get Started Guide

By following this guide, you’ll learn everything you need to start improving your credit today with confidence. Let’s take the next step together toward achieving your financial goals!

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!