If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

Having a repossession (repo) on your credit report can feel like a heavy weight, but understanding what a repo is, how it works, and how you can manage its impact can lift some of that burden. Let’s dive into what repos are, how they can affect your credit, and how you can tackle them with tools like the Dispute Beast DIY Credit Repair Software.

What Is a Repo and How Does a Repo Work?

A repossession, commonly referred to as a “repo,” occurs when a lender takes back an item, usually a vehicle, from a borrower who has failed to make payments according to their loan agreement. This is a lender’s last resort to recover some of their loss. The process can be initiated after just a few missed payments, depending on the terms set by your loan agreement. The repo agent can legally seize your vehicle without prior notice, often taking it right from your driveway!

How to Proactively Prevent a Repo

The best strategy to avoid a repo is to maintain open communication with your lender. If you foresee financial trouble that might delay payments, reach out to discuss potential solutions like loan modification, extended payment periods, or even deferment. Setting up automatic payments can also help you stay on track and avoid accidental defaults.

How Does a Repo Affect Your Credit Profile?

A repo can severely damage your credit score, often dropping it by 100 points or more. This negative mark stays on your credit report for up to seven years. It not only lowers your score but also makes you appear risky to future lenders, which could result in higher interest rates or difficulty in obtaining future credit.

READ ME NEXT: Take charge of your credit with our easy 11-step guide! Learn how to fix your credit yourself, save money, and avoid costly services. Ready to start? Click here to read the guide for free!

Additional Consequences of a Repo on Your Credit Profile

Having a repossession on your credit report can lead to several additional consequences beyond just a lower credit score and challenges in securing future credit. Here are some potential impacts:

- Higher Interest Rates: If you’re able to secure credit after a repo, you might face significantly higher interest rates. Lenders see you as a higher risk, which often results in less favorable loan terms to offset that risk.

- Insurance Premiums: Many people don’t realize that their credit score can affect their insurance premiums. Insurers often use credit information to determine risk profiles for auto and homeowners insurance. A lower credit score can lead to higher premiums.

- Employment Opportunities: Some employers check credit reports as part of the hiring process, particularly for positions that involve financial responsibilities or government work. A repo could negatively impact your job prospects or promotions.

- Housing Options: Landlords often check credit reports to assess the reliability of potential tenants. A repossession could make it more difficult to rent an apartment or house, as it signals financial instability to the landlord.

- Security Deposits: Poor credit resulting from a repo could lead to higher security deposits on utilities or rental properties. Service providers and landlords might require these as a safeguard against potential defaults.

- Emotional and Psychological Stress: The impact of financial stress should not be underestimated. Having a repo on your credit report can lead to increased anxiety and stress about financial security and future opportunities.

Understanding these consequences can help underscore the importance of managing credit responsibly and taking proactive steps to address any negative items on your credit report.

How To Remove a Repo with DIY Credit Repair Software: Dispute Beast

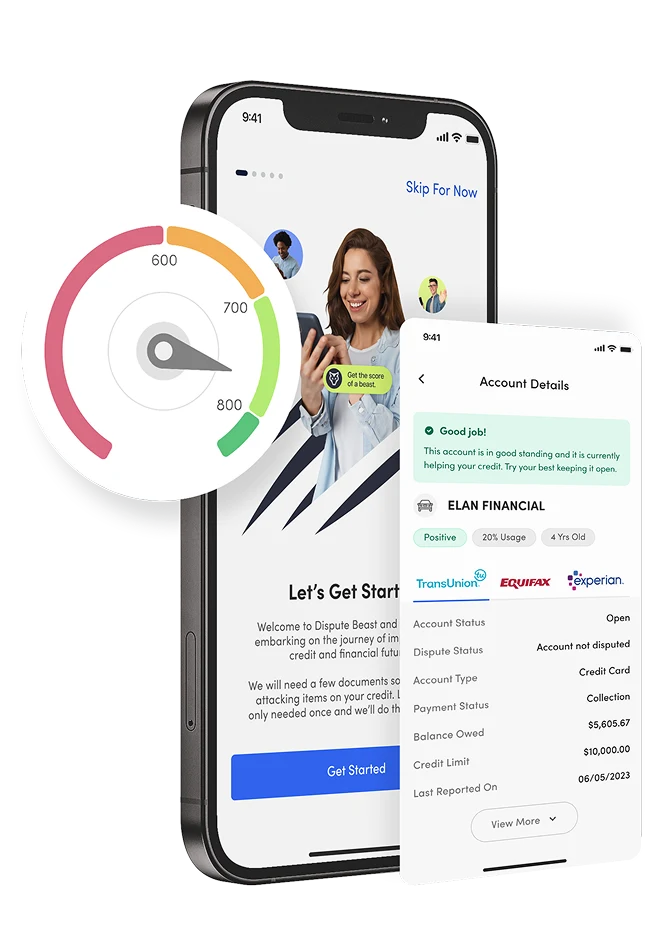

When it comes to repairing your credit from a repo, Dispute Beast offers a robust solution. Touted as the most advanced and effective DIY credit repair software in the world, Dispute Beast simplifies the repair process. It only requires adding beast credit monitoring, and the software does the rest. It attacks the repo on three levels:

- Attacking the Credit Bureaus: It starts by challenging the repossession listing with the major credit bureaus.

- Attacking the Data Furnishers: The software then goes after the creditors or lenders who reported the repo, ensuring they have all the correct documentation.

- Attacking the Secondary Bureaus: Finally, it targets smaller credit reporting agencies, making sure the repo is removed from all records.

The process is user-friendly: just load your Beast Credit Monitoring credit report, press one blue button, mail your letters, and repeat every 40 days until you achieve the desired results. It’s designed to be fun and easy, turning a daunting task into a manageable project.

Wrapping It Up

Dealing with a repo on your credit report isn’t fun, but it’s not the end of the world. With proactive management and the right tools like Dispute Beast, you can work towards removing negative marks and improving your credit score. Remember, every step taken is a step towards financial stability and peace of mind.

If you’re considering changing the font used in your Dispute Beast letters to something you think might work better, let’s take a moment to understand why the font is chosen the way it is.

FREE RESOURCE: Boost your credit score with our Ultimate Guide to DIY Credit Repair! Discover 11 simple steps and how Dispute Beast can empower you to take control of your credit. Ready to improve your financial health? Click here to learn more!

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!