If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

When it comes to credit repair, not all late payments are created equal. At Dispute Beast, we take a smarter, more strategic approach to analyzing your credit profile. Unlike other tools that automatically attack every late payment, Dispute Beast evaluates the entire account to determine the best course of action, ensuring that every action taken benefits your credit as much as possible. This hands-on approach is the first step toward achieving financial freedom.

To further demonstrate our confidence in the system and the value for your money, Dispute Beast offers a 110% money back guarantee. This guarantee ensures that if certain requirements are not met, you get more than your money back, making it a risk-free opportunity to achieve your credit goals.

Introduction to Credit Repair

Credit repair is the process of taking control of your financial future by identifying and addressing inaccuracies or negative items on your credit report. Whether you’re dealing with outdated information, reporting errors, or unfair negative marks, these issues can drag down your credit score and limit your access to better financial opportunities. That’s where Dispute Beast comes in—offering a powerful DIY credit repair system that puts you in the driver’s seat.

With Dispute Beast, users can challenge and dispute errors on their credit reports using expertly crafted dispute letters and attack letters. If you believe there is a mistake on your credit report, you can dispute the mistake directly and work toward having it corrected. This hands-on approach allows you to directly target negative items, correct mistakes, and steadily improve your credit score. The process is designed to be straightforward and effective, giving you the tools and confidence to take charge of your credit repair journey. As you work to improve your credit, you’re not just boosting your score—you’re opening the door to greater financial freedom and control over your financial destiny.

We value authentic feedback from our users. Please consider leaving a review of your experience with Dispute Beast to help others make informed decisions.

Understanding Credit Bureaus

Credit bureaus are the gatekeepers of your credit information, collecting data from lenders and other sources to create your credit reports. The three major credit bureaus—Equifax, Experian, and TransUnion—play a pivotal role in determining your credit score and, ultimately, your ability to secure loans, credit cards, or even a new home. Understanding how these bureaus operate is essential for anyone serious about credit repair and credit improvement.

Dispute Beast takes a comprehensive approach by not only targeting the primary credit bureaus but also addressing secondary bureaus and data furnishers that may be reporting negative items on your credit profile. By leveraging Dispute Beast’s tools, users can dispute inaccuracies across all relevant bureaus, ensuring that every possible avenue for credit improvement is explored. Staying consistent with your disputes and monitoring your credit profile puts you a step closer to your financial goals, helping you reduce negative items and achieve the credit score you deserve.

Dispute Strategy and Attack Letters

Dispute Beast’s dispute strategy and attack letters are at the heart of its powerful approach to credit repair and credit improvement. By combining advanced technology with proven dispute tactics, Dispute Beast gives users the tools they need to challenge negative items on their credit reports and move a step closer to financial freedom. Whether you’re dealing with late payments, charge-offs, or collections, Dispute Beast’s system is designed to help you break free from the cycle of bad credit and start building a brighter financial future.

The platform’s three-level dispute strategy targets every angle of the credit reporting process. Dispute Beast doesn’t just focus on the main credit bureaus—Equifax, Experian, and TransUnion—but also goes after secondary bureaus and data furnishers that may be reporting negative items on your credit profile. This comprehensive approach ensures that no stone is left unturned in your quest for credit improvement. Each dispute letter and attack letter is tailored to your unique credit situation, maximizing the effectiveness of every challenge and helping you stay consistent in your efforts.

With Dispute Beast, you’re in control of your credit repair journey. The system’s DIY credit repair tools make it easy to manage your disputes, track your progress, and make informed decisions about your next steps. The attack letters generated by Dispute Beast are crafted to address specific negative items on your credit report, increasing your chances of success with credit bureaus and data furnishers. Plus, with Sprint Mail, you can rest assured that your dispute letters are delivered quickly and efficiently, so you never miss a beat in your credit repair process.

One of the standout features of Dispute Beast is its commitment to user support and transparency. The platform provides clear answers to your inquiries, helping you understand the effectiveness of different dispute strategies and empowering you to make the best choices for your financial journey. Real results from users across the country prove the quality and effectiveness of Dispute Beast’s approach, and the 110% money-back guarantee means you can trust the process and feel secure in your investment.

Getting started is simple—just sign up for your free Dispute Beast account and take the first step toward taking control of your credit. By managing your credit profile, staying consistent with your disputes, and utilizing the full range of tools and resources available, you can improve your credit score and get your financial life back on track. Dispute Beast’s dispute strategy and attack letters are more than just a service—they’re your pathway to financial freedom, better credit scores, and the confidence to pursue your goals.

Why Dispute Beast May Not Attack Certain Late Payments

For late payments that occurred in years 4, 5, 6, or 7, these typically have minimal impact on your credit score because older late payments weigh less heavily in credit scoring models like FICO and VantageScore. Additionally, these payments will naturally fall off your credit report after 7 years + 180 days from the date of delinquency.

If the account is otherwise positive—meaning it has a strong payment history overall and contributes to the length of your credit history—attacking it could do more harm than good. Removing an account with late payments from years 4 to 7 may result in the loss of a positive account, which could lower your score by shortening your credit history or decreasing the average age of your accounts.

In these cases, Dispute Beast recognizes that leaving the account as-is may be the best option for your overall credit profile.

The Three Ways Dispute Beast Handles Late Payments

Dispute Beast takes a tailored approach to late payments and evaluates each account individually to determine the most beneficial strategy for you. Dispute Beast’s method can be seen as operating on three levels: choosing not to dispute, updating late payments, or pursuing full deletion. These three levels represent a multi-layered approach to challenging collections and errors on your credit report.

Depending on the situation, Dispute Beast will handle late payments in one of three ways:

- No Attack

If an account is mostly positive and attacking it would harm your credit profile (e.g., by reducing the average age of your accounts or removing a positive account), Dispute Beast will choose not to attack it. This ensures that no unnecessary damage is done to your credit.

- Update Late Payments

In some cases, Dispute Beast will attack the account and request that specific late payments be updated to “Never Late, Paid as Agreed.” This approach allows you to retain the account while removing the negative marks associated with late payments. Dispute Beast is very precise in targeting the exact months with late payments to maximize the chances of success. As part of this process, a formal dispute letter is sent to the credit bureaus or data furnishers to address the specific late payments.

- Full Deletion

If an account provides no benefit to your credit profile (e.g., it has poor payment history and high utilization), Dispute Beast will attack the account and request its complete removal from your credit report. This strategy is used when the account is doing more harm than good. The dispute process involves making a specific claim regarding the inaccuracy or harm of the account, and creditors or bureaus may be required to provide proof to substantiate the reported information.

You Have Full Control Over What Gets Attacked

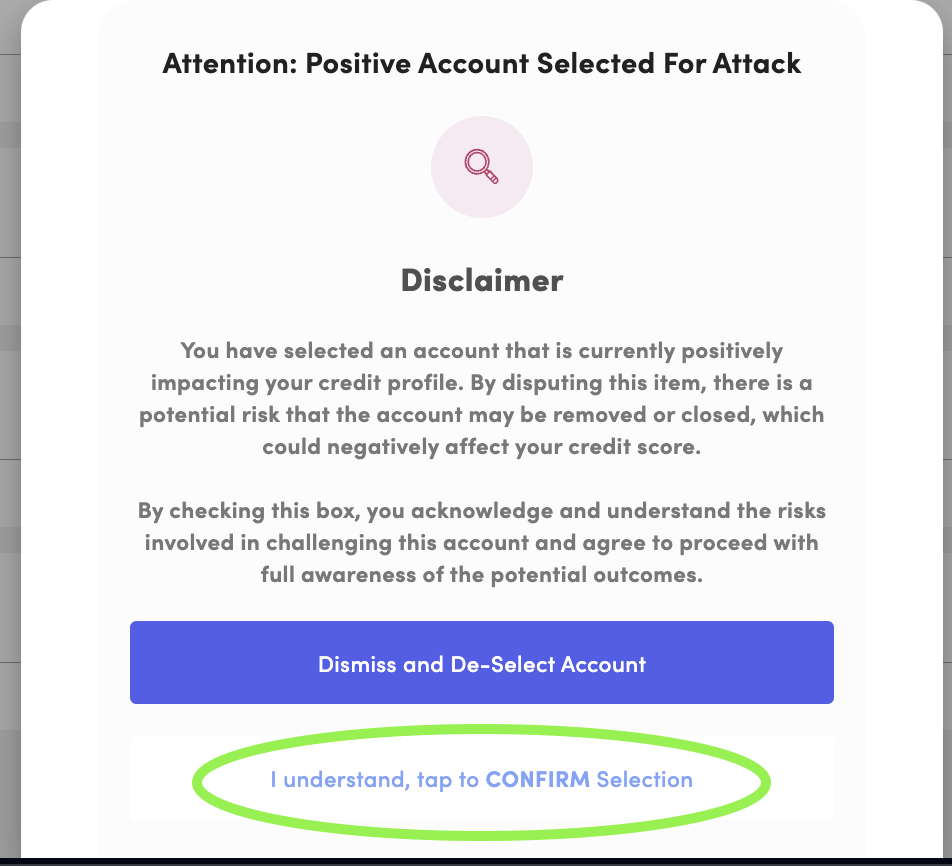

While Dispute Beast makes strategic decisions about what to attack based on your credit profile, you always have 100% control over the process. If you feel strongly that an account should be included in your attack, you can manually select it. Here’s how:

• Press the blue attack button.

• Select the account you want to target.

• Agree to the disclaimer that pops up.

• Dispute Beast will include the account in your next attack.

This functionality allows you to override the system’s recommendations and ensures that you can address any account you feel needs attention. This process is similar to how inquiries are handled within the platform.

Why a Strategic Approach Matters

Not all credit repair tools are created equal. Many other systems automatically attack every late payment without considering the broader impact on your credit profile. This “one-size-fits-all” approach can often do more harm than good, such as removing positive accounts that contribute to your credit score. Dispute Beast is intended to provide users with a secure and effective credit repair experience.

Dispute Beast’s methodology is different. By evaluating each account’s unique contribution to your credit profile, it ensures that every attack is designed to maximize your score improvements while minimizing potential harm. Dispute Beast also implements measures to protect users from spam, fraud, and abuse during the credit repair process. This strategic approach is why Dispute Beast is one of the most effective tools for credit improvement.

Tips for Success with Dispute Beast

While Dispute Beast works hard to optimize your attacks, here are some additional steps you can take to boost your credit score. Actively managing your credit profile throughout the credit repair process is crucial for long-term success:

- Pay Down Balances: Lowering your credit utilization to 1-6% of your credit limits can significantly improve your score, as utilization makes up 30% of your credit score.

- Pay Bills On Time: Consistent, on-time payments are the foundation of a strong credit profile. Payment history accounts for 35% of your credit score.

- Be Patient and Consistent: Credit repair is a process, and it often takes multiple attacks (typically 4-6 rounds) to see significant results. You may need to repeat the dispute process over several rounds, as credit bureaus sometimes claim repeated disputes are identical, but persistence and strategic variation are key.

By following these tips and using Dispute Beast, you can improve your credit scores and increase your chances of getting approved for loans, credit cards, or other financial products.

Final Thoughts

Dispute Beast is designed to make credit repair as strategic and effective as possible. By carefully analyzing your credit profile, it determines the best approach for handling late payments, whether that means leaving a positive account alone, updating late payments to “Never Late, Paid as Agreed,” or requesting the complete deletion of a harmful account.

Remember, you’re always in control of what gets attacked, and our team is here to support you every step of the way. If you have questions or need assistance, don’t hesitate to reach out—we’re committed to helping you achieve your credit goals.

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!