Your credit score isn’t just a number — it’s a profile lenders read like a story. And when that story contains mistakes, even small ones, your score can drop, interest rates can rise, and approvals can disappear without warning. The problem? Most credit report errors aren’t obvious. They hide in the fine print, in the reporting dates, or in accounts that “look correct” at first glance.

This guide breaks down the hidden errors most people never notice, the ones that quietly damage your score for months or even years. You’ll learn how to detect them, how to dispute them correctly, and how AI tools make the entire process faster and more accurate.

Before going deeper into advanced detection, if you need the fundamentals, review our pillar guide on credit report errors.

Why Hidden Credit Report Errors Are So Dangerous

Most consumers assume that only big, obvious mistakes hurt them — like accounts they don’t recognize or identity theft. But the truth is far worse:

- Small reporting inconsistencies can drop your score by 20–60 points.

- Incorrect dates can extend derogatory marks for years.

- Duplicate accounts can inflate your debt and tank utilization.

- Outdated inquiries can make you look desperate for credit.

These aren’t dramatic errors — they’re subtle ones. They trick consumers into thinking everything is fine while lenders quietly make decisions based on false data.

If you want proof, the Consumer Financial Protection Bureau reports that 34% of people find at least one error on their report.

The 7 Hidden Credit Report Errors Most People Miss

1. Incorrect “Date Opened” or “Date of First Delinquency”

These are the most damaging invisible errors on a credit report. A wrong date can:

- Restart the 7-year reporting clock.

- Make a debt appear newer than it is.

- Allow a collection to stay longer than legally allowed.

Even a “small” date mismatch of 30 days can impact how scoring models calculate risk.

2. Duplicate Accounts Reporting from Different Sources

This error happens when an old debt gets transferred or sold. Instead of one account, your report shows two — or three.

To FICO, this looks like:

- Double the debt

- Double the missed payments

- Double the risk

This is one of the top issues we resolve inside Dispute Beast using automated scanning that flags duplication instantly.

3. Wrong Account Status (Closed Showing as Open)

This error makes lenders think you have more active debt than you actually do. It can ruin:

- Debt-to-income ratios

- Utilization rates

- Risk assessments

Worse, it’s extremely easy to miss.

4. Incorrect Payment History — The Hidden 30-Day Late

Payment history is 35% of your score. One payment incorrectly marked “late” can drop a score by 50–120 points.

And the craziest part?

Most consumers don’t even notice. They assume the creditor is correct.

AI tools, however, can compare payment patterns and identify reporting inconsistencies instantly.

5. Reporting Errors After Bankruptcy Discharge

This is incredibly common.

After a bankruptcy is discharged, accounts must legally be reported as:

- “Included in bankruptcy”

- $0 balance

- No new late payments

Yet many creditors continue reporting balances or new delinquencies — which is illegal.

6. Hard Inquiries That Are Not Authorized

Hard inquiries should only appear when you explicitly give permission.

If you see unknown inquiries, dispute them immediately. They indicate either:

- Fraud

- Careless lender reporting

- A lender “shotgunning” your application without permission

If you need a full guide on this topic, see our resource on how to dispute hard inquiries.

7. Balance and Limit Errors That Ruin Utilization

Your utilization rate can swing your score by more than 100 points. Even tiny balance errors — wrong limit, outdated reported balance, or a creditor forgetting to update — can trigger big scoring changes.

For more detail, review what affects utilization most in the Experian utilization guide.

How to Detect These Hidden Errors (Step-by-Step)

Most people read their credit report like a document. AI reads it like data — scanning patterns, dates, amounts, and inconsistencies in milliseconds.

But whether you use AI or not, here’s the exact process to detect invisible errors:

Step 1: Pull All Three Reports

You must review:

- Experian

- Equifax

- TransUnion

Most errors appear on only one report — which is why consumers miss them.

Step 2: Compare Every Data Point Across Bureaus

This includes:

- Open dates

- Closed dates

- Balances

- Limits

- Payment history

- Status descriptions

AI dispute tools do this instantly through a process called cross-bureau pattern recognition.

Step 3: Mark Anything That Doesn’t Match

Even if it’s small.

Example errors easy to overlook:

- Balance differs by $1 between bureaus

- Date differs by 1 month

- Status is listed as “open” in one bureau, “closed” in another

These matter. Scoring models read them differently.

Step 4: Match Dates Against Actual Statements

Creditors frequently report incorrect dates. Always verify with:

- Bank statements

- Loan documents

- Payment confirmations

Step 5: Dispute the Errors with Documentation

Your dispute must include:

- A clear explanation of the error

- Evidence (statements, letters, screenshots)

- The correct information

If you don’t phrase disputes correctly, bureaus can reject them automatically. To avoid this, learn exactly how to contact credit bureaus effectively.

How AI Fixes These Errors Faster

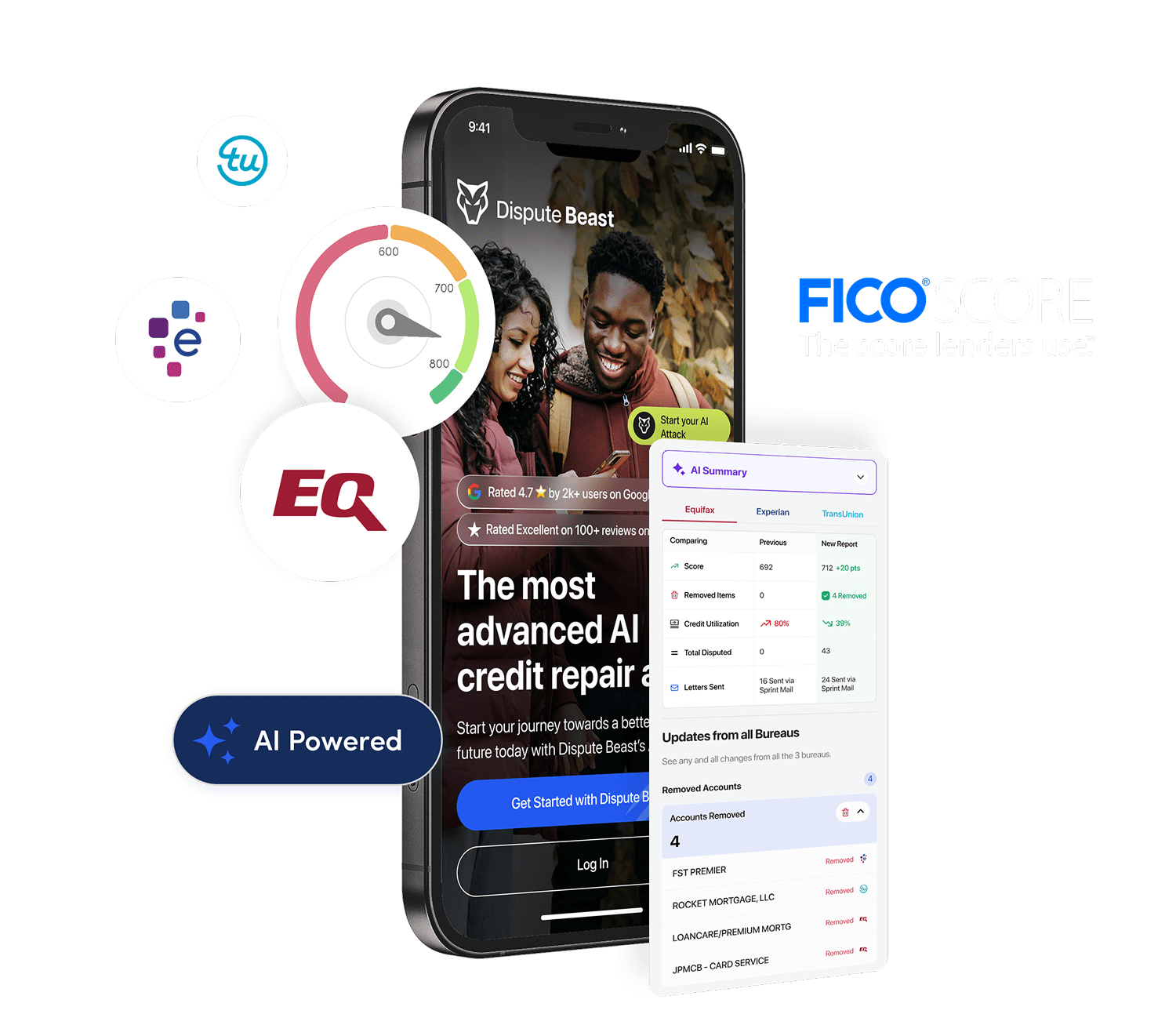

AI tools like Dispute Beast can detect, categorize, and dispute errors at scale. Here’s what AI does that humans don’t:

1. Detects Errors Instantly

Machine learning analyzes:

- Date inconsistencies

- Duplicate accounts

- Utilization deviations

- Unexpected inquiry patterns

2. Drafts Tailored Dispute Letters Automatically

Instead of templates, AI uses customized evidence-based language that increases success rates.

3. Tracks Bureau Responses and Auto-Follows Up

This is where most consumers fail. AI handles:

- 30-day follow-up cycles

- Supplementary dispute rounds

- Escalations

4. Identifies New Errors as They Appear

Credit files update monthly — and new errors appear all the time. AI monitors every update.

When to Escalate a Dispute

If the creditor or bureau refuses to correct an error, escalate when:

- The same error appears after 2 dispute cycles

- The bureau claims the information was “verified” incorrectly

- The creditor refuses to update dates or balances

Some escalations may require filing a complaint with the CFPB or sending a method-of-verification request.

Don’t Let Hidden Errors Cost You Approval

The biggest credit score drops come from errors people never saw coming — the small ones buried deep inside your report.

If you want AI to scan, detect, and dispute these errors instantly, explore our guide on how inquiries affect your file or jump directly into automated dispute tools through Dispute Beast.

Fixing these hidden errors can raise your score faster than months of credit repair habits alone.