If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

Understanding how credit utilization impacts your credit score is crucial when it comes to managing your credit card usage. At Dispute Beast, we often encounter questions about the best practices for credit card spending and payment. Let’s dive into these aspects in detail, ensuring you have a clear strategy for using your revolving credit effectively.

What is Credit Utilization?

Credit utilization refers to the percentage of your credit limit that you use at any given time. A common misconception is that maintaining a utilization rate of 30% is ideal. However, keeping your utilization between 1-6% is more beneficial for optimal impact on your credit score. If you have a credit limit of $1,000, you should spend between $10 to $60. This tight control helps demonstrate that you are a responsible borrower who manages credit judiciously.

Understanding your credit Statement Date, Due Date, and Reporting Date

Navigating your credit card’s statement date, due date, and reporting date is essential for maintaining a healthy credit score and avoiding unnecessary interest.

Statement Date

The statement date is when your credit card issuer finalizes your billing statement for the current cycle. This includes all transactions, payments, and fees accrued up until this date. The balance shown as of this date will be reported to the credit bureaus. Therefore, if you want to showcase low credit utilization, you need to pay down your balance before this date.

Due Date

The due date follows the statement date and is when your minimum payment—or more if you choose—must be paid to avoid late fees. This date is typically 21-25 days after the statement date, giving you a grace period to pay off your balance without incurring interest.

Reporting Date

The reporting date is when your credit card company reports the information from your statement to the credit bureaus. This date can be the same as your statement date but sometimes differs depending on the creditor’s reporting practices. The reported balance affects your credit score and is used to calculate your credit utilization rate.

READ ME NEXT: Take charge of your credit with our easy 11-step guide! Learn how to fix your credit yourself, save money, and avoid costly services. Ready to start? Click here to read the guide for free!

Credit Utilization Tips from Dispute Beast

At Dispute Beast, we recommend that you either consistently keep your utilization under 6%, or if you occasionally use more of your available credit, make sure you know your statement date. This allows you to pay it down to the optimal 1-6% range before the balance is reported. Keeping within this range can significantly enhance your credit score since revolving credit accounts for 30% of its calculation.

How to calculate your credit utilization ratio

Calculating your credit utilization ratio manually is a simple process that you can perform in just a few steps. First, determine your total credit limit across all of your credit cards. Next, add up the balances on each card. Finally, divide the total balance by the total credit limit and multiply the result by 100 to get your credit utilization ratio as a percentage.

For example, if you have a total credit limit of $10,000 across all of your cards and a total balance of $2,000, your credit utilization ratio would be 20% ((2,000 ÷ 10,000) x 100).

While it’s easy to manually calculate your credit utilization ratio, keeping track of your balances and limits across multiple credit cards can be time-consuming.

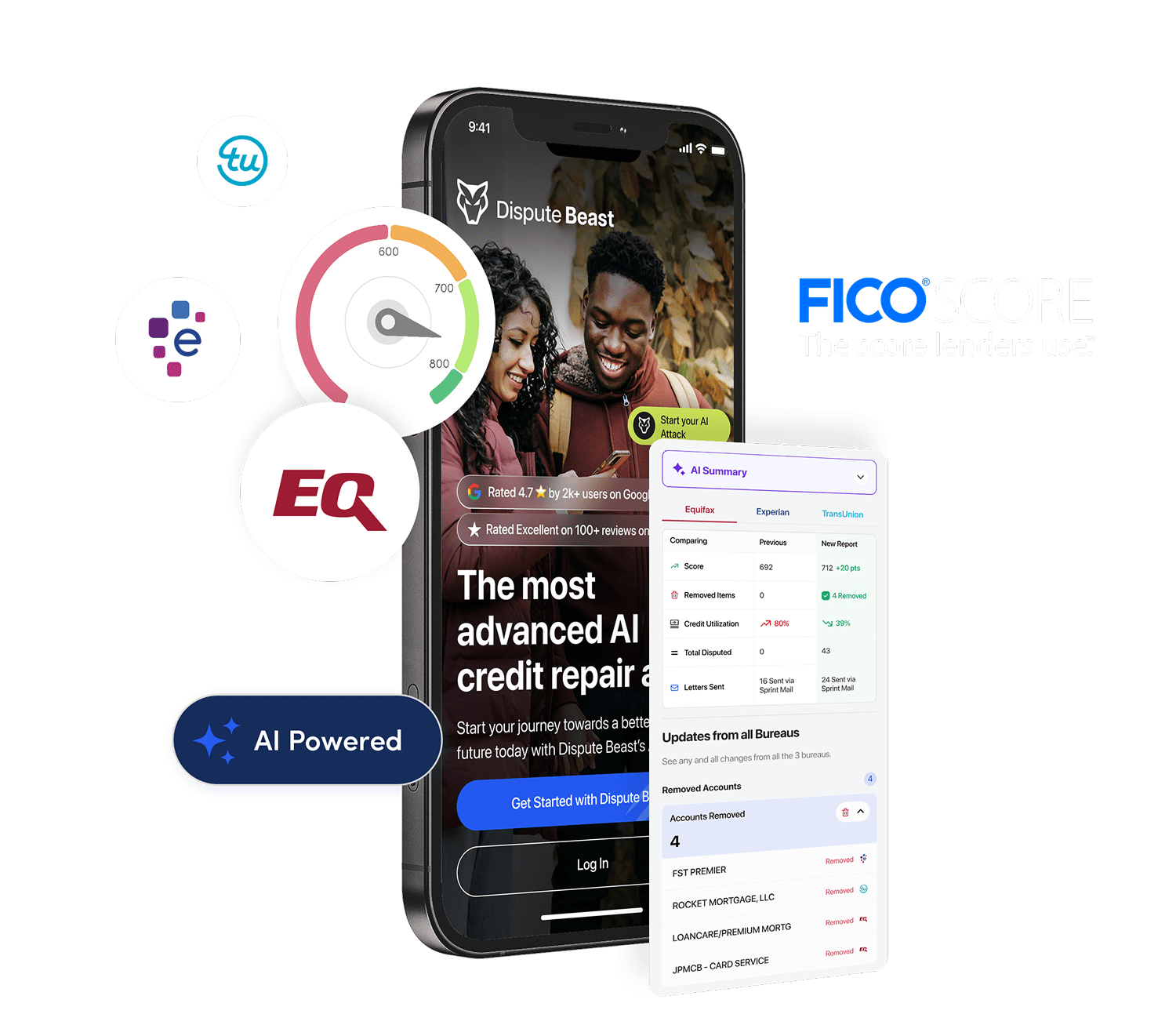

That’s where Dispute Beast comes in. Our platform automatically calculates your credit utilization ratio for you and shows you a breakdown of your credit usage across all your accounts.

This makes it easy to monitor your credit utilization and adjust your spending habits to maintain a healthy credit score.

To see your credit utilization ratio on Dispute Beast, simply login to your account and navigate to the Total Utilization section.

From there, you can view your utilization ratio and other important credit metrics, such as your credit score and credit report.

Here’s a screenshot of what the Total Utilization looks like on Dispute Beast:

Monitoring Your Credit Utilization with Dispute Beast

Our services at Dispute Beast include showing you all the revolving credit accounts reporting to the major credit bureaus and exactly what your utilization percentage is. It’s important to note that what you see on your credit card statement and what is reported can be 30-45 days behind. Therefore, even if you pay off your balance today, the reported balance might not reflect this payment immediately.

Final Thoughts

Managing your credit card effectively requires a strategic approach to spending and payments. Always aim to understand the intricacies of credit reporting and utilize tools like those provided by Dispute Beast to keep on top of your financial behaviors. You can positively influence your credit score by maintaining a low utilization ratio and being aware of your statement and reporting dates.

Remember, effective credit management is about consistency and informed decisions. Keep your utilization low, monitor your credit regularly, and adjust your spending habits to align with credit reporting cycles. By following these guidelines, you’ll be well on your way to maintaining a healthy credit score, which opens the door to better financial opportunities.

FREE RESOURCE: Boost your credit score with our Ultimate Guide to DIY Credit Repair! Discover 11 simple steps and how Dispute Beast can empower you to take control of your credit. Ready to improve your financial health? Click here to learn more!

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!