Introduction

For decades, repairing credit meant frustration—endless letters, confusing templates, and waiting months for uncertain results.

Now, Artificial Intelligence is rewriting the story.

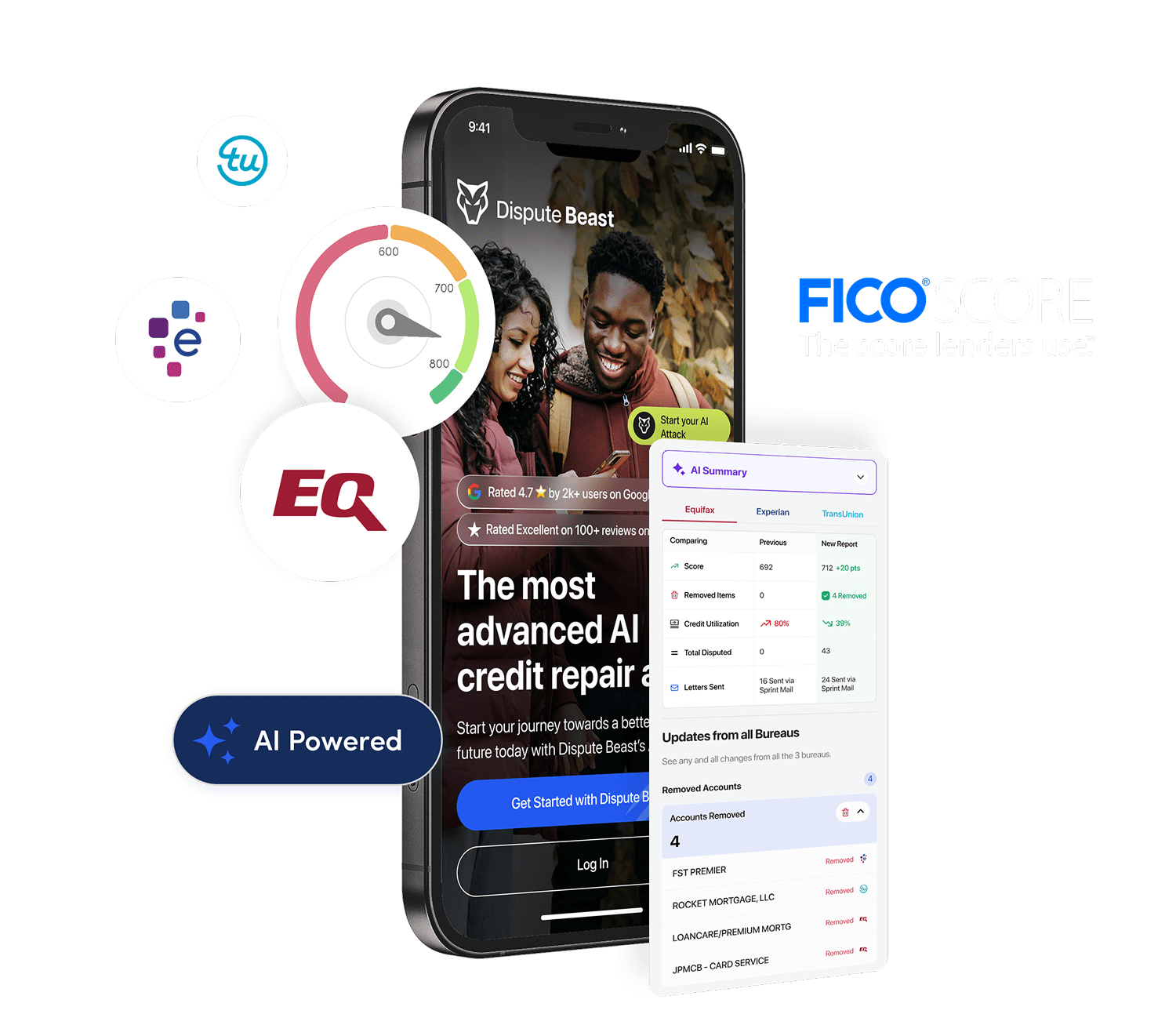

Through AI Credit Dispute technology, platforms like Dispute Beast empower consumers to challenge inaccuracies faster, smarter, and 100 % compliantly.

This isn’t just automation—it’s a movement giving users full control of their financial future with one button: Attack.

1. The Problem With Traditional Credit Repair

Old-school credit repair relied on manual drafting, guesswork, and monthly service fees.

You’d pay someone to send generic dispute letters and hope for results.

The issues were obvious:

- Manual data review = slow turnaround.

- Cookie-cutter templates flagged as “frivolous.”

- Little visibility into what’s happening behind the scenes.

That’s where Dispute Beast steps in—transforming manual frustration into automated precision.

2. Dispute Beast and the AI Credit Dispute Revolution

Dispute Beast is the most advanced and effective DIY credit repair software ever built.

Powered by automation and compliance intelligence, it helps users take control of their credit with a simple, one-click Attack System.

Here’s what sets it apart:

- Free access when users maintain an active paid subscription to Beast Credit Monitoring (Vantage 3.0) or Pro Credit Watch (FICO 8).

- Three-Level Attack Strategy—targeting bureaus (Experian, Equifax, TransUnion), creditors, and secondary bureaus like LexisNexis, Innovis, and CoreLogic.

- Automated 40-Day Attack Cycles that analyze reports, identify new negatives, and send fresh rounds every 40 days in full FCRA and Metro 2 compliance.

- Integration with Beast Credit Monitoring and Pro Credit Watch so users track real progress using the same FICO 8 and Vantage 3.0 models lenders rely on.

With Dispute Beast, the power of automation is finally in the consumer’s hands.

3. How AI Turns Data Into Disputes

Every 40 days, Dispute Beast’s AI engine reviews the latest credit reports from Experian, Equifax, and TransUnion.

It cross-references data against Metro 2® standards, detects inconsistencies, and auto-generates factual, compliance-based letters citing the proper consumer protection laws.

No templates. No typos. No missed violations.

Just machine-level accuracy with human-level strategy.

4. Factual and Compliance-Based Disputing

Dispute Beast’s letters aren’t generic—they’re built on laws that protect consumers: FCRA, FDCPA, and Metro 2 reporting guidelines.

Each letter includes references to specific regulations and case law precedents, making it far more effective than typical credit repair templates.

Example: If an account is marked “open” after settlement, Dispute Beast flags the Metro 2 violation and auto-drafts a custom letter for that furnisher and bureau.

This approach isn’t aggressive—it’s accurate. And that’s why it works.

5. Personalization That Gets Attention

Every letter Dispute Beast creates looks unique. Fonts, formats, and layouts change between rounds (handwritten vs printed styles), making each submission stand out in bureau systems.

It’s a small detail that dramatically increases response rates—and it’s done automatically for you.

6. Automated 40-Day Attack Cycles

Credit repair is a process, not a miracle. That’s why Dispute Beast runs on consistent 40-day cycles.

After each cycle:

- The system pulls fresh reports.

- Analyzes new data and outcomes.

- Generates the next set of letters.

- Tracks every response and deadline.

This relentless rhythm keeps your credit “in training”—building strength round after round. Like fitness, results come from consistency.

Most users see significant improvement after 6–12 attack rounds while practicing good habits (on-time payments, low utilization, limited inquiries).

7. Transparency and Progress Tracking

Thanks to integration with Beast Credit Monitoring and Pro Credit Watch, you can track progress in real time using the same scoring models used by lenders.

Dispute Beast’s dashboard shows exactly which items were challenged, their status at each bureau, and which attack round you’re on.

No mystery—just measurable progress.

8. Three-Level Attack Strategy in Action

Most credit repair efforts focus only on the big three bureaus. Dispute Beast goes further.

- Primary Bureaus: Experian, Equifax, TransUnion.

- Data Furnishers: Creditors and collection agencies reporting inaccuracies.

- Secondary Bureaus: LexisNexis, Innovis, CoreLogic, and others that feed data to lenders and insurers.

By disputing across all three levels simultaneously, Dispute Beast delivers comprehensive coverage and long-term accuracy across your entire credit profile.

9. AI + Human Expertise = Results

Behind every automated attack cycle is a foundation of expertise. Dispute Beast’s AI handles analysis and drafting, while its team of credit specialists monitors compliance and edge cases.

This hybrid approach ensures speed without sacrificing accuracy or ethics—a rare balance in the credit repair industry.

10. AI and Financial Inclusion

AI Credit Dispute technology is helping more people than ever gain fair access to credit.

According to PYMNTS, AI credit systems are expanding financial inclusion for millions with thin or damaged files.

By eliminating inaccurate negatives, Dispute Beast helps users qualify for better loan terms, insurance rates, and housing approvals—restoring opportunity through accuracy.

11. Predictive Protection and the Future of Credit Repair

Dispute Beast is pioneering the next phase of AI Credit Dispute: prevention.

Future updates will use predictive analytics to:

- Detect potential reporting errors before they impact scores.

- Simulate score changes before sending attacks.

- Provide real-time compliance audits exportable for legal use.

As Forbes notes, AI is poised to handle over 60 % of credit communications by 2026. Dispute Beast is already there—leading the AI-driven credit empowerment era.

12. The Mindset That Wins

Credit repair isn’t a quick fix—it’s a habit.

Just like fitness, you build results by showing up consistently.

Every 40 days is a new round. Every letter is a rep.

Keep attacking, stay compliant, and watch your credit strengthen with each cycle.

Dispute Beast does the heavy lifting—you just press Attack and stay consistent.

Conclusion: Smarter Disputes, Stronger Credit

AI is transforming credit repair—and Dispute Beast is leading the charge.

By combining automation, compliance, and personalization, it turns a once-confusing process into a simple habit you can master yourself.

No monthly fees. No guesswork. Just results built on discipline, law, and data.