If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate Dispute Beast FAQ to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health!

If you are serious about maximizing your credit repair efforts efficiently and affordably, Dispute Beast is the ultimate tool. Make sure to read the ultimate reviews to fully understand how you can leverage this powerful DIY Credit Repair system to transform your financial health! Dispute Beast equips you with the ability to take control of your credit repair journey, empowering you to make informed decisions and achieve better results.

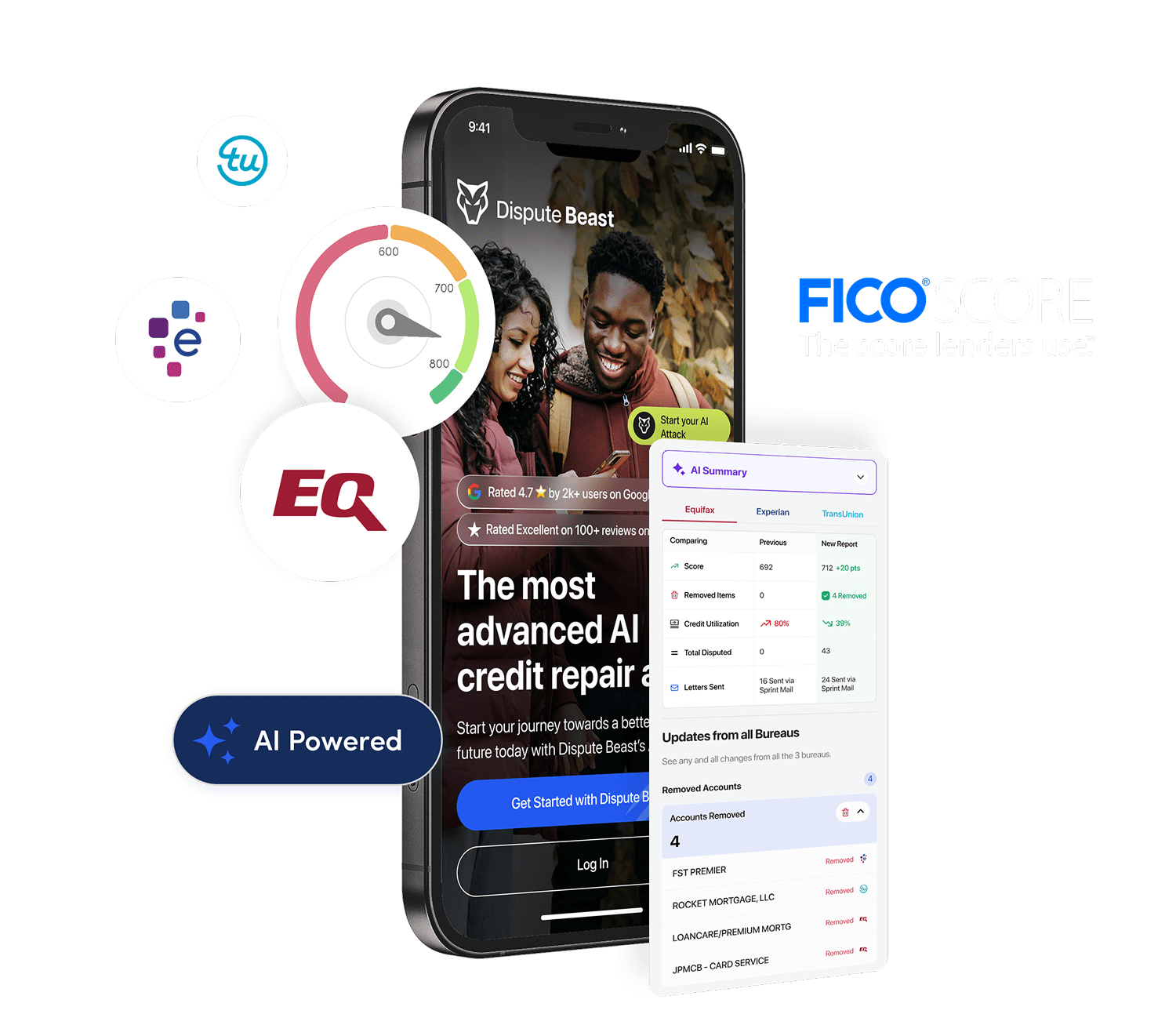

If you’ve been wondering whether you need FICO scores to improve your credit, here’s the truth: both FICO and VantageScore analyze the same credit report data. At Dispute Beast, we use Beast Credit Monitoring with Vantage 3.0 and now also offer Pro Credit Watch with FICO 8 scores — “The scores that the lenders use.” This means you get both perspectives: Vantage for trend tracking and FICO 8 for the same scores most bank lenders rely on when making approval decisions.

Introduction to Credit Repair

Credit repair is all about taking control of your financial future by identifying and disputing errors on your credit report to improve your credit scores. The credit repair industry has evolved to offer a wide range of credit repair software and services designed to make the credit repair process more accessible and effective for everyone. A significant number of consumers face errors on their credit reports that can lower their scores, making these tools even more essential. With tools like Dispute Beast and Credit Versio, users can simplify the process, track their progress, and achieve better results with less hassle.

These platforms offer key features such as credit monitoring, automated dispute letters, and educational resources, empowering users to manage their credit with confidence. Whether you’re looking to fix errors, remove negative items, or simply keep an eye on your credit, credit repair software provides the tools and support you need to improve your scores and take charge of your financial health.

Why Vantage 3.0 Works for Credit Improvement

- Same Data, Different Models

Both FICO and VantageScore analyze your payment history, credit utilization, account age, and other key credit factors. The difference lies in how each model calculates your score—think of it as two chefs using the same ingredients to make different recipes.

- Focus on the Report, Not the Credit Scoring Model

Improving your credit isn’t about whether you’re looking at a FICO score or a VantageScore—it’s about the accuracy of the data on your credit report. Both scoring models rely on the same information, so the key to better scores is ensuring that your report is free of negative items, errors, and inaccuracies. Effectively managing your credit report and disputes is essential to achieving the best possible results.

When you use Dispute Beast, you’re targeting the data that matters most: late payments, collections, charge-offs, and more. Cleaning up your credit report benefits all scoring models because they’re just different ways of analyzing the same information. The real goal is to build a strong, clean credit profile, and Dispute Beast gives you the tools to make it happen.

- Scores Improve Over Time

As you improve your credit report—by disputing errors, removing late payments, or lowering your credit utilization—you’ll see positive changes in both VantageScore and FICO. That’s because they rely on the same data. By following these steps, you can increase your credit scores over time and open up more financial opportunities.

- VantageScore Is Widely Accepted

While FICO is traditionally used for certain lending decisions, VantageScore is accepted by many banks, lenders, and financial institutions. It’s widely used for pre-approvals, credit card applications, and even mortgages.

- Action Drives Results

The most important step in improving your credit is taking action—not worrying about which scoring model is displayed. Dispute Beast helps you address the issues holding back your creditworthiness, giving you the power to unlock better financial opportunities.

Understanding FICO and VantageScore

Here’s a quick breakdown of the two scoring models:

• FICO Score: The traditional and widely recognized credit scoring model used by many lenders to assess creditworthiness.

• VantageScore: Developed by the three major credit bureaus, VantageScore is gaining traction among lenders and provides another reliable way to measure credit health.

While they calculate scores differently, both models use the same credit report information. Improving your credit report benefits both.

Why Are My Credit Scores Different Across Various Sources?

It’s common to notice differences in your credit scores when comparing sources like Credit Karma, the Experian app, or Beast Credit Monitoring. Here’s why: Your credit score is a snapshot in time, calculated based on the data available at the moment it’s pulled.

Different scoring models—like Vantage 3.0, FICO 8, or FICO 10T—use different algorithms to analyze your credit report, which leads to different scores. Even if the same algorithm is used, scores can vary if they’re pulled on different dates, as new data (such as balance updates, new inquiries, or account changes) may have been added to your report.

Beast Credit Monitoring is essential for tracking your progress because it’s the foundation of your attacks. However, if you decide to also look at sources like Credit Karma or the Experian app, compare your starting score on that platform to where you are after several months or six rounds of attacks. It’s helpful to monitor your credit score changes month by month to see steady progress and identify trends.

For example, if you’re using Beast Credit Monitoring along with Credit Karma, track your Credit Karma score from where you started to where you end up. The same applies if you’re using the Experian app in addition to Beast Credit Monitoring—only compare progress within that specific source. Different credit repair tools or sources can be reviewed to determine which is most effective for your needs. Remember, your credit score reflects the data on your credit report. With consistent attacks, timely bill payments, and low utilization, you’ll see improvement over time. Always stay focused on one source to accurately measure your success.

Dispute Process

The dispute process is the heart of credit repair. It involves carefully reviewing your credit report, identifying errors or inaccuracies, and disputing them with the credit bureaus. Credit repair software like Dispute Beast streamlines this process by providing users with tools to generate dispute letters, automate submissions, and track the status of each dispute. Dispute Beast’s approach includes attacking creditors and secondary bureaus in addition to the major bureaus, ensuring a more comprehensive strategy for improving your credit.

With the right software, the dispute process becomes incredibly easy, saving you time and effort while increasing your chances of better results. These tools also help you communicate effectively with collection agencies and lenders, ensuring that your disputes are handled efficiently. Dispute Beast attacks data furnishers and secondary credit bureaus for a more comprehensive approach, giving you the best chance to clean up your credit report. By automating much of the process, you can focus on monitoring your progress and watching your credit scores improve over time.

Security and Safety

When it comes to credit repair, security and safety are non-negotiable. Credit repair software and services must prioritize the protection of your personal data at every step. The verification successful waiting process ensures that only real users—never bots—can access sensitive information, adding an extra layer of security. Dispute Beast provides enhanced personalization by customizing letters for each round of dispute using varied fonts, making the process more effective and tailored to individual needs.

Dispute Beast, for example, uses secure connections and advanced data encryption to keep your information safe. Completing the verification process gives you peace of mind, knowing your data is protected. With a commitment to transparency and quality, trusted credit repair software ensures your credit scores and reports are managed with the utmost care, so you can focus on improving your credit with confidence.

Customer Support

Excellent customer support is a cornerstone of any effective credit repair software or service. Users need to know that help is available whenever they need it, whether it’s assistance with dispute letters, credit monitoring, or navigating the credit repair process. Responsive support teams can make a significant difference in achieving better results and improving your credit scores.

Platforms like Dispute Beast offer a range of tools and features to help users manage their credit, and their customer support teams are there to guide you every step of the way. By providing timely assistance and expert advice, these services empower users to take control of their credit, resolve disputes, and work toward financial freedom with confidence.

Why Choose Dispute Beast?

Dispute Beast is trusted by thousands of customers, with nearly 5-star reviews on Google praising its ease of use, affordability, and proven results. The effectiveness of Dispute Beast is consistently highlighted in customer testimonials, demonstrating real improvements in credit scores. Our platform empowers you to clean up your credit report quickly, securely, and effectively—no matter which scoring model you focus on. Customers place their trust in Dispute Beast, and we proudly stand by the quality and reliability of our services. With Dispute Beast, you’ll have the tools to take control of your financial future.

Getting started is simple. You can send your first attack in less than five minutes by following our step-by-step guide. Read the blog here to learn how easy it is to start improving your credit today.

Beyond offering both Vantage 3.0 and FICO 8 scores, Dispute Beast gives you unmatched advantages:

- FICO scores via Pro Credit Watch

- 110% money-back guarantee

- SOC 2 Type 2 security for the highest data protection (learn more)

- 24/7 email support

- Live coaching calls (Mon–Thurs)

Dispute Beast provides live coaching calls for additional support during the credit repair process, ensuring users have access to expert guidance whenever needed.

Reminders!

- Read the Ultimate Dispute Beast FAQ for answers to all your questions!

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button by going to https://disputebeast.com/ and clicking get started

- To continue using Dispute Beast, you must maintain an active and paid subscription to Beast Credit Monitoring at all times!

Keep Attacking: Don’t forget to keep up with those attacks every 40 days! Dispute Beast will take a good look at your report and go after any new negatives that have popped up. But hey, I know you might be wondering how long it takes to improve your credit. Let’s think of it like getting in shape. The best results come from consistently eating right and hitting the gym. Same goes for credit improvement. Dedicate 6-12 attack rounds while paying your bills on time, keeping your utilization low (between 1-6%), and limiting your inquiries. This combo should yield some amazing results. Remember, your credit score is a byproduct of your financial behavior. Just like the numbers on the scale fluctuate, your credit score will too. Stay focused, stay consistent, and you’ll see the results you deserve!