Most people start a credit report dispute expecting an instant win: you submit a dispute, the bureau “investigates,” and your score jumps. When that doesn’t happen in a week or two, the process feels broken. It isn’t. Credit disputes run on timelines and batch updates, and the outcomes you want usually show up through repeated, compliant rounds—not a single message to a bureau.

This guide breaks down what really happens over the first 30, 60, and 90 days, what changes behind the scenes at each stage, and what you should do (and avoid) if you want real results. It’s educational—not legal advice—but it follows the realities of how bureaus and data furnishers operate under the Fair Credit Reporting Act (FCRA) timelines.

Why credit disputes take time

A dispute is not a request for a score increase. It’s a formal process that forces a “reinvestigation” of specific data on your credit file. That reinvestigation involves multiple parties:

- Credit bureaus (Experian, Equifax, TransUnion) receive the dispute and manage the investigation workflow.

- Data furnishers (creditors, collection agencies, lenders, servicers) supply the information being reported and must respond to the dispute.

- Internal verification systems (often automated) match your claim to the furnisher’s stored records and decision rules.

Federal rules typically require bureaus to complete investigations within about 30 days for many disputes, but “30 days” is not the end of the story. Data can update asynchronously, furnishers can respond late, and different bureaus can process corrections on different schedules. For a plain-English overview of consumer dispute rights and timelines, review the CFPB’s guidance on disputing errors on your credit report.

The dispute timeline at a glance

Here’s the most useful mental model for disputes in 2026:

- Days 1–30: Intake → forwarding → verification response. You learn how the furnisher reacts.

- Days 31–60: Refinement → pressure → pattern recognition. Better disputes outperform generic ones.

- Days 61–90: Escalation → compliance risk → resolution. This is where momentum compounds.

Think of it like training, not a one-time workout. The credit file responds to consistent, correct pressure applied on schedule.

Days 1–30: What really happens in the first cycle

The first 30 days are the “baseline round.” This is where most people misunderstand the process, because the first round often ends with “verified” even when an item is questionable. That doesn’t always mean you’re wrong—it often means your dispute was too generic to force meaningful verification.

Step 1: Your dispute is logged and coded

When you submit a dispute, the bureau codes it into standardized categories. This matters because certain dispute types trigger faster verification paths and certain ones get routed into “auto-verify” logic. Vague disputes like “this is wrong” frequently get treated as low-information claims.

Step 2: The bureau forwards the dispute to the furnisher

In many workflows, the bureau sends the dispute to the furnisher through an electronic system. The furnisher then checks internal records and responds. If the furnisher responds “verified,” the bureau typically keeps the item as-is unless you provided specific contradictions or documentation that creates a conflict.

Step 3: You get one of three outcomes

- Verified: The furnisher confirms the reporting as accurate (or claims it is).

- Updated/Corrected: A field changes—balance, dates, status, or payment history.

- Deleted: The item is removed from the bureau report.

In the first 30 days, deletions happen most often when errors are obvious (duplicated tradelines, wrong account, mixed file indicators) or when the furnisher can’t locate the documentation quickly enough.

What you should focus on in days 1–30

- Precision: Dispute specific fields, not the entire account.

- Consistency: Track which bureau shows which fields incorrectly.

- Documentation readiness: Keep statements, letters, screenshots, payment confirmations, and identity documents organized.

Days 1–30 are about learning how the account responds. Your goal is to gather signal: what got verified, what changed, and what the furnisher appears willing to correct.

Days 31–60: What changes after the first response

This is the phase where most people quit—and where disciplined disputers start winning. After the first investigation, you now have a history: the bureau’s result and the furnisher’s stance. That history lets you craft a second-round dispute that is more targeted and harder to auto-dismiss.

Why round two is where leverage begins

Round one creates a record. Round two exposes inconsistencies. If an account was “verified” but key fields conflict with other bureau data, your follow-up can force the dispute into a more meaningful review path. Repeated verification without adequate substantiation increases compliance risk, especially when you dispute specific Metro 2 fields, dates, or statuses that do not align with other records.

Common improvements that appear in days 31–60

- Status changes: “Charge-off” to “Closed,” “Collection” to “Paid,” “Open” to “Closed.”

- Date corrections: Date of first delinquency, last payment date, last reported date.

- Balance corrections: Current balance, past due amount, high credit limits.

- Duplicate removal: Duplicated collections or the same debt reported twice.

These may look “small,” but underwriters don’t treat them as small. One corrected date or status can materially change how a lender interprets risk, even before the score moves.

What you should focus on in days 31–60

- Refine your dispute language: Reference the exact field that is wrong and what a correct reporting would show.

- Dispute where it matters: If the error originates with the furnisher, direct disputes may be appropriate (FCRA §623 concepts), while bureau disputes address what the bureau displays.

- Stay compliant: Don’t spam disputes daily. Use structured cycles and keep copies of everything.

This stage is also where a system matters. The difference between “sending another letter” and “sending a better letter on schedule” is often the difference between a stagnant file and a progressing file.

Days 61–90: Escalation, compliance pressure, and real resolution

By the third stage, you’re no longer asking politely—you’re documenting a repeated inability to verify or correct disputed fields. If a furnisher keeps verifying information that is inconsistent across bureaus or unsupported by documentation, they carry increased compliance exposure.

Why the third stage produces more deletions

At this point, many furnishers prefer deletion over continued dispute friction—especially with older debts, purchased collections, or accounts with thin documentation. If your dispute is accurate, specific, and supported by consistent record-keeping, the third stage is where outcomes frequently compound.

Typical outcomes in days 61–90

- Permanent deletions: Collections, duplicates, and unverifiable tradelines removed.

- Hard corrections: Payment history and status corrected across bureaus.

- Stabilization: Less “reappearing” data because the furnisher updates internal records.

Not every account deletes by day 90. But if you’re going to see meaningful progress, it often begins to show by the third stage—especially when you repeat compliant dispute rounds.

What changes at each stage inside your credit score

Your score does not respond instantly to disputes for two reasons: (1) bureau updates may post on different days than the dispute resolution, and (2) scoring models respond to the changed data differently depending on what was corrected.

Days 1–30: Score movement is often minimal

In round one, you might see little to no score change even if a field corrected—especially if the correction doesn’t meaningfully change utilization, derogatory count, or age metrics. This is normal.

Days 31–60: Structural changes start to register

As statuses, balances, and duplicates correct, your file begins to look cleaner. This is when scores often begin to respond, though the changes can still be uneven across models.

Days 61–90: Deletions can create noticeable shifts

When a major derogatory item deletes or duplicates disappear, scores can move more substantially. The key is that the dispute process is targeting the right items, not random items.

Manual vs automated vs AI dispute workflows

“How long disputes take” is influenced heavily by how they’re run. Here is the realistic difference between common approaches:

| Approach | What it looks like | Typical weakness | Best use case |

|---|---|---|---|

| Manual disputes | You write letters or file online disputes yourself | Inconsistent timing, vague language, poor tracking | Simple, obvious errors with clear documentation |

| Automated dispute cycles | Systematic rounds with templates + tracking | Still may lack personalization or multi-level escalation | Multi-round disputes where discipline matters |

| AI-assisted dispute workflow | Detection + targeted drafting + repeatable cycles | Requires correct inputs and a compliant process | Complex errors and repeated verification patterns |

If you want to see what a modern AI-assisted workflow looks like end-to-end, review the AI credit dispute workflow and compare it to typical one-off disputes.

The mistakes that stall disputes (and stretch the timeline)

When people say “my dispute didn’t work,” it’s often one of these issues:

- Disputing the entire account instead of specific fields: Broad disputes get broad (often automated) responses.

- Using generic templates without context: “Not mine” and “inaccurate” without substance is easy to dismiss.

- Stopping after the first verification: The first response is often the least meaningful.

- Chasing speed instead of structure: Daily disputes create noise, not leverage.

- Disputing accurate information: If it’s verifiable and correct, it won’t delete—and it can waste cycles.

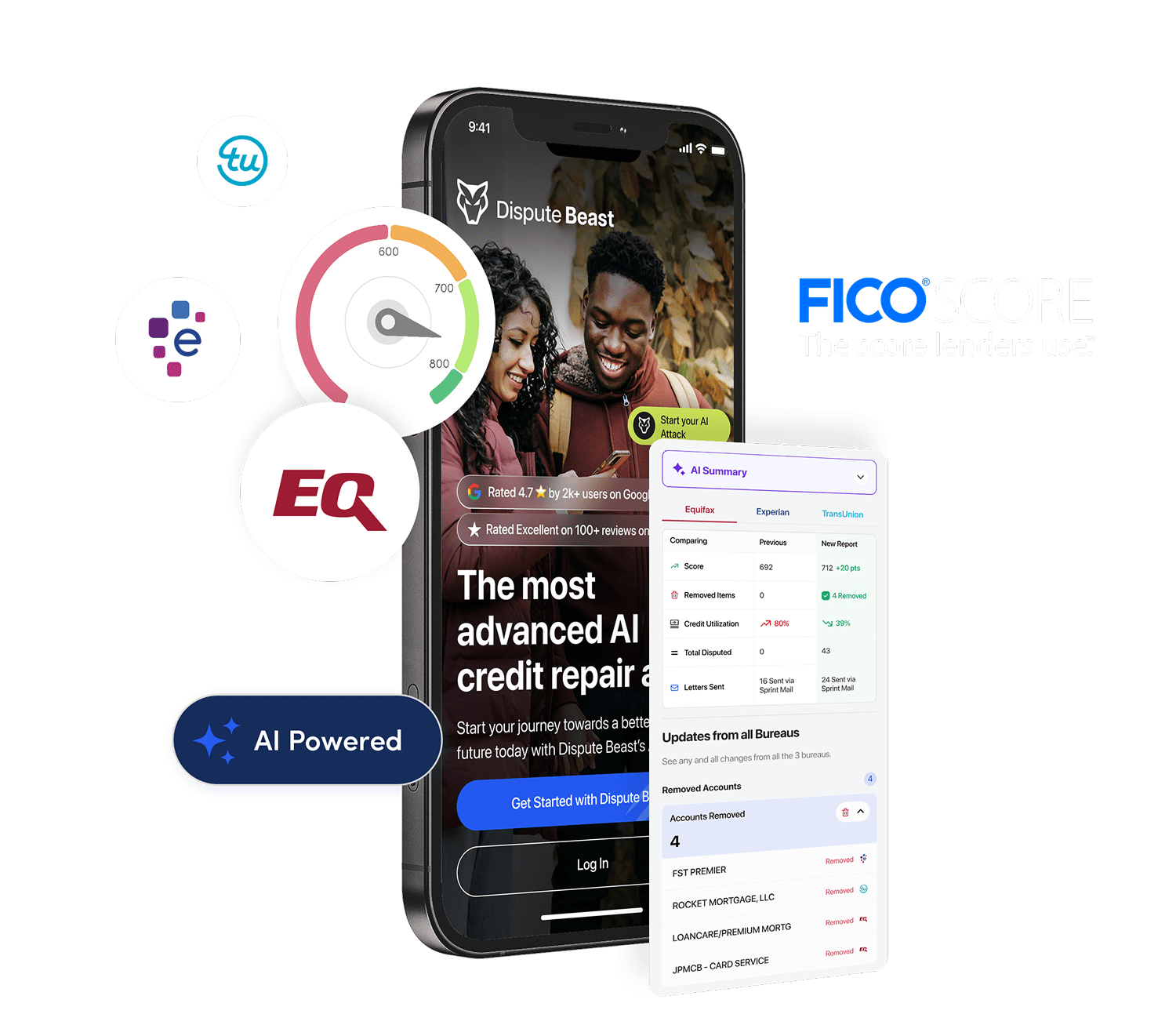

How Dispute Beast is designed for the 30–60–90 reality

Dispute Beast is the most advanced DIY credit repair software, built for people who want a structured, compliant system rather than a random sequence of disputes. It was designed around the reality that progress happens through repeated rounds—like fitness: the results come from consistency.

- Three-Level Attack Strategy: disputes at the bureaus, directly with data furnishers/creditors, and with secondary bureaus.

- Automated 40-Day Attack Cycles: analyzes your newest report every cycle and produces the next set of dispute letters.

- Compliance-based letters: crafted around consumer protection laws, Metro 2 standards, and dispute best practices.

- Ease of use: load your report, press one button, print and mail, repeat on schedule.

That’s why the timeline matters. The system is built to keep you attacking in compliant rounds until the file changes.

Practical expectations: what “progress” looks like at 30, 60, and 90 days

At 30 days

- You have dispute outcomes: verified / updated / deleted.

- You can identify which bureau is reporting the worst fields.

- You have a roadmap for round two.

At 60 days

- Partial corrections often start to appear.

- Duplicates and obvious errors are more likely to move.

- Your dispute language becomes sharper and more targeted.

At 90 days

- Escalation begins to compound: deletions and permanent corrections show up more often.

- Your file becomes more consistent across bureaus.

- You can see which negatives are “stubborn” and need multi-level pressure.

Final takeaway: treat disputes like a system

Credit disputes are not an event. They’re a repeatable system that works best when you apply correct pressure, on schedule, for long enough to force resolution. The 30–60–90 day framework helps you stay strategic, patient, and consistent.

Next steps

- Read the Ultimate Dispute Beast FAQ for answers to common questions.

- Get your free Dispute Beast account and start sending your attacks with the press of 1 button.

- Keep Attacking Every 40 Days: consistent rounds are where most results appear.